Maximum Borrowing Amount for a Housing Loan in Japan

When you consider using a housing loan to purchase real estate in Japan, it is important for you to first understand how much you can borrow from a bank. If you know the approximate amount you can borrow, you may get to know the amount that you need as your own funds, the budget of the real estate that you purchase, etc., and it may be easier for you to make a financial plan. We will explain here the basic concept and calculation method of how the maximum loan amount of a housing loan is determined.

If you are a foreigner and want to know about financial institutions that can provide housing loans, please see Guide to Home Mortgage Loans in Japan.

Criteria for determining the Maximum Housing Loan Amount

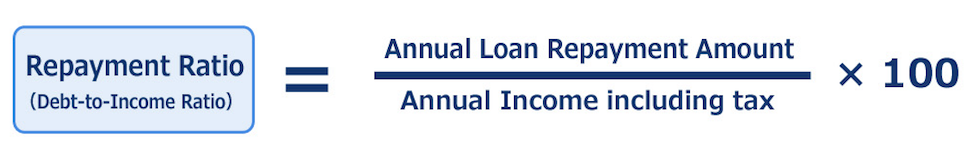

The most important point for financial institutions to check when screening a housing loan is Repayment Ratio (Debt-to-Income Ratio). These are the criteria that indicate “the ratio of the annual repayment amount to the annual income” of the loan user, and it is generally said that repayment may be made without difficulty if the repayment ratio is within 25 – 30%.

Repayment Ratio (Debt-to-Income Ratio) = Annual Loan Repayment Amount / Annual Income including tax x 100

*Annual Loan Repayment Amount includes car loans, credit-card loans, etc. aside from a housing loan.

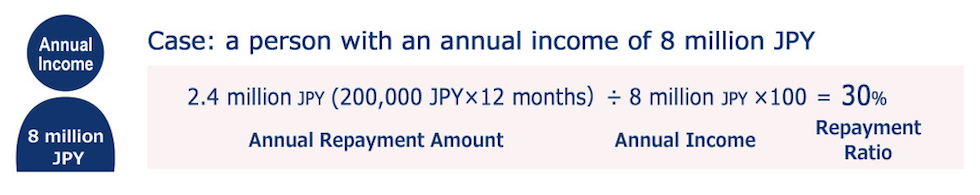

For example, when a person with an annual income of 8 million JPY repays a housing loan of 200,000JPY per month, the repayment ratio is calculated as follows:

2.4 million JPY (200,000JPY x 12 months) ÷ 8 million JPY x 100 = 30%.

The screening criteria for the repayment ratio, vary depending on the financial institution, but the maximum loan amount may be within 30-35%. If the repayment ratio is high, the burden of repayment will be heavier and the risk of delinquency will increase, so your loan application may not pass the screening, or the borrowing amount may be less than desired.

How to calculate the borrowable amount

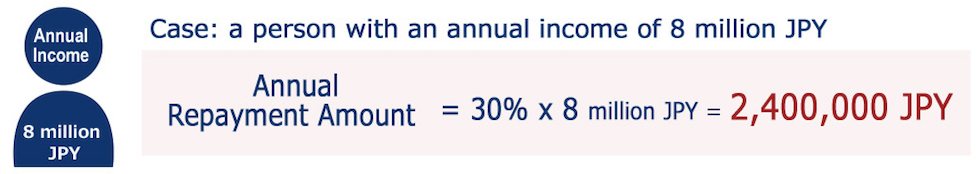

First, let us show you the calculation of the annual loan repayment amount with the repayment ratio of 30%.

- The case of the annual income of 8 million JPY

Annual loan repayment amount = 30% × 8 million JPY (Annual income) = 2,400,000JPY

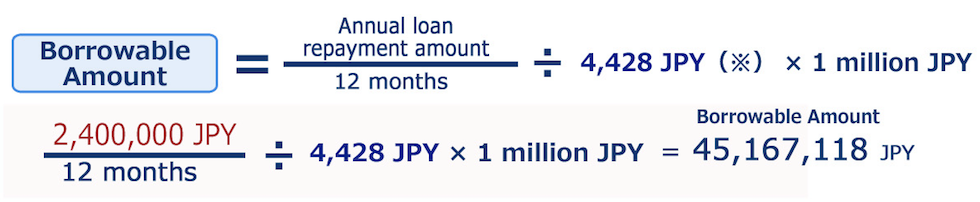

The borrowable amount is calculated by the following formula.

Borrowable amount = Annual loan repayment amount ÷ 12 months ÷ 4,428 JPY(*) × 1 million JPY

2,400,000 JPY ÷ 12 months ÷ 4,428 JPY × 1 million JPY = 45,167,118 JPY

If you have an annual income of 8 million JPY, 45.16 million JPY is a rough estimate of the borrowable amount.

*The amount of 4,428 JPY used in the above calculation formula corresponds to the monthly repayment amount per 1 million JPY when borrowing 1 million JPY for 35 years at the interest rate for loan screening of 4%. The interest rate for loan screening is the interest rate used in the housing loan screening and is different from the actual applicable interest rate, but each financial institution uses an interest rate around 4% to hedge risks in consideration of possible rise in interest rates during the repayment period.

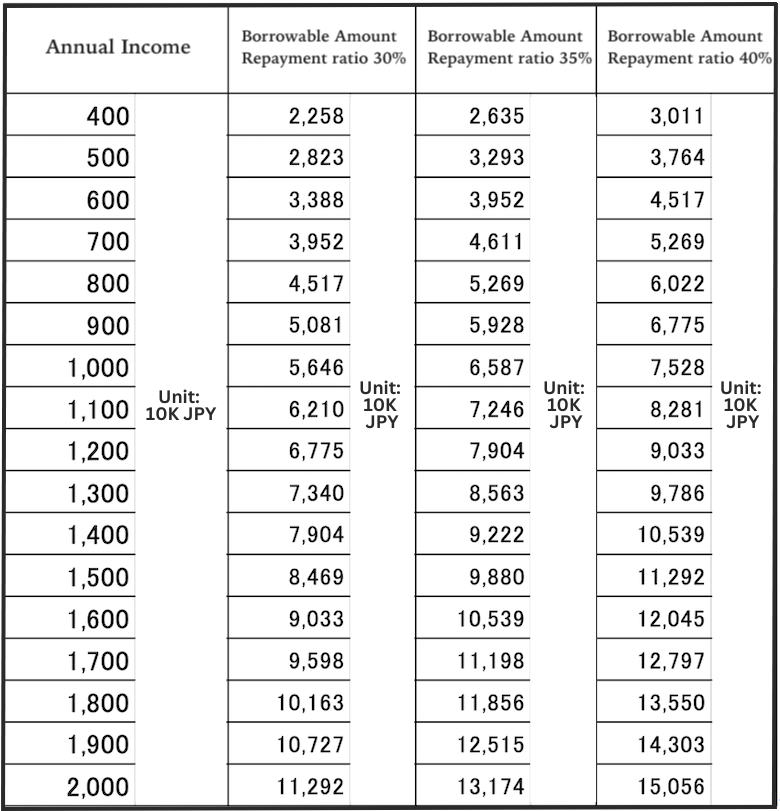

The following is a quick reference table of borrowable amounts by annual incomes based on the above calculation.

Quick Reference Table of borrowable amounts by annual incomes

Repayment ratio: 30% / 35% / 40% (Estimated by Interest rate for loan screening of 4%, Repayment period of 35 years)

Each financial institution’s website provides a housing loan simulation that allows you to estimate the amount you can borrow and the amount you can repay based on your desired conditions, so you can also make a trial calculation by using an actual plan of housing loan interest rate.

Example:

SMBC Trust Bank Housing Loan Simulation

https://bit.ly/3NN3Uu7

SBI Shinsei Bank (In Japanese only, see “Estimate Borrowable Amount”)

https://bit.ly/3XGuQ3b

How many times your annual income can you borrow?

In general, the maximum borrowing amount for a housing loan in Japan is about 7 times your annual income. According to the above Quick Reference Table, the borrowable amount can be estimated to be about 5.5-7.0 times your annual income.

Although it is different from the borrowing amount, for your reference, we will show you the ratio of the purchased real estate prices to annual incomes (annual income multiplier) based on the “Flat 35 users survey in 2021”.

New custom-built houses with land: 7.5 times

Newly built houses for sale: 7.0 times

New custom-built houses: 6.8 times

New condominiums: 7.2 times

Preowned houses: 5.7 times

Preowned condominiums: 5.8 times

Looking at the results, you can see that Flat 35 users purchase the properties that are 5.7-7.5 times their annual income. When purchasing a property, many people about 10 or 20% of the funds as a down payment, so in that case, the housing loan amount will be reduced by the down payment. The annual income multiplier is the multiplier of your annual income to the purchase price, and the borrowing amount varies depending on each situation, so please refer to it only as a guide for the price of the property to be purchased.

What is collateral valuation for housing loans?

In a housing loan agreement, a financial institution takes out a “mortgage” on the purchased property. A “mortgage” is the right that allows the lender of the loan agreement to hold the property as collateral and to sell the property to repay the loan if the borrower is unable to repay (did not repay) it. Therefore, financial institutions calculate the collateral valuations of such purchased properties to see how much they are likely to be sold for realistically. Each financial institution uses its own standards for valuation of real estate collateral, but as a guide, the value is about 80% of the market price.

In the event of non-repayment, the financial institution may have to sell the collateralized property to pay off the remaining balance of the loan, so a significantly low collateral valuation of the purchased property may result in a reduction from the desired loan amount. Buildings with old earthquake standards, wooden detached houses over 10 years old, lands with leasehold rights, tenant-occupied houses, etc. tend to have lower collateral valuations.

Can I Get Home Loan with Zero Down Payment?

In the screening of housing loans, as described above, the borrower’s ability to repay and the collateral valuation of the purchased property is checked and comprehensively evaluated, but whether the attributes of the individual as a borrower are good or not is also important in the screening. Attributes refer to the person’s place of work, annual income, age, family structure, residential property information, whether or not the borrower has other loans, etc., and are indicators to determine the risk of the borrower’s non-repayment of the housing loan.

People who have a stable job, a high annual income, and a long period of employment may be evaluated as having good attributes, and will be positively evaluated in the screening, making it easier to get a housing loan without a down payment or a borrowing amount over the purchased property value.

- Rental Apartments & Houses in Tokyo

- Listings of popular and luxurious rental apartments, condominiums, and houses designed with expats in mind.

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.