What is Group Credit Life Insurance (Danshin)? - Insurance attached to a Housing Loan

When taking out a housing loan, you are required to join “Group credit life insurance” as one of the conditions of the loan. Group credit life insurance is a life insurance policy specifically for housing loans that reduces the loan debt to zero in the event that a housing loan borrower dies or becomes severely disabled during the loan repayment period. It is designed to ensure that the remaining family members will not have financial difficulties in repaying the loan even if something should happen to the housing loan debtor during the long repayment period. Recently, financial institutions are diversifying their services by providing various special clauses and services, such as those that cover lifestyle-related diseases like cancer and diabetes.

In this article, we will explain the features of a group credit life insurance, the types of the insurance, and the points on how to choose it.

1. Features of Group Credit Life Insurance (Danshin)

A housing loan borrower are obliged to join Danshin

Housing loans from private financial institutions require you to join Danshin. It is an insurance that can be purchased only when taking out a housing loan and when refinancing. You cannot join it after taking out a housing loan or change your plan in the middle of the loan period.

As an exceptions, to purchase the insurance is optional for Flat 35, which is a long-term fixed interest rate housing loan provided by the Japan Housing Finance Agency.

Health status report is required

Since this is a type of life insurance, you must report to the insurance company any of your pre-existing diseases, medical history, and your present health status. The applicant fills out and submits the Notice of Health Status form on his/her own as a self-assessment.

In some cases, such as the case of a housing loan over 50 million JPY or adding a special insurance rider, a health certificate may be required.

If the insurance company rejects your application, you may not be able to join Danshin, and as a result, you may not be approved for a housing loan.

Insurance premiums are included in the interest rate of a housing loan

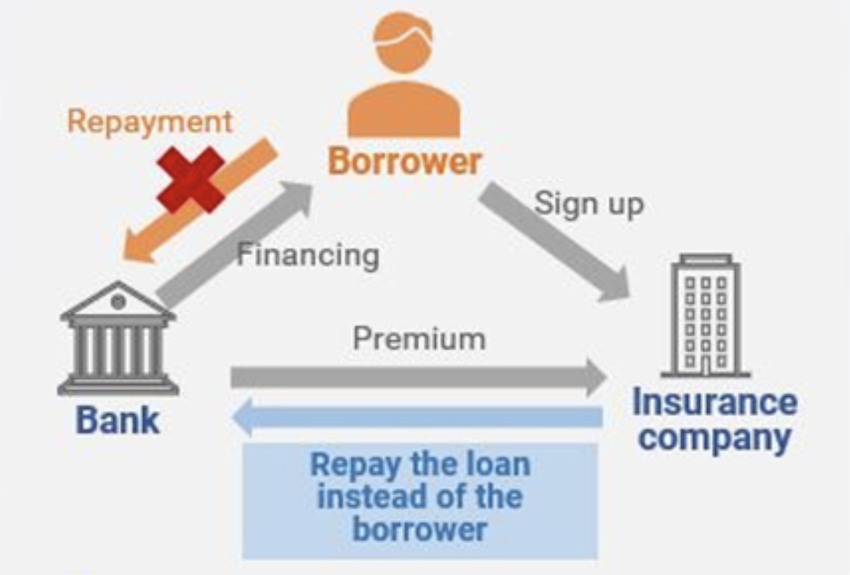

The insurance premium is included in the interest rate of a housing loan, therefore you don’t need to pay the premium. A financial institution pays the insurance premium to an insurance company from the interest paid monthly by a housing loan borrower.

if a special rider is added to the insurance policy in addition to the basic death and severe disability coverage, an interest rate of about 0 to 0.3% per annum is often added to the housing loan. Unlike most of the life insurance, the premiums do not vary depending on the age or gender of the policyholder.

The beneficiary of the insurance proceeds is a financial institution

The beneficiary of the insurance money paid by Danshin is the financial institution that is financing the housing loan. The financial institution receives the insurance proceeds from the insurance company and repays the remaining loan balance. So, repayment by the housing loan borrower (debtor) or his/her family will no longer be required.

The guarantee period is the repayment period of the housing loan

Normally, the guarantee period of Danshin starts at the same time as the housing loan is executed, and the guarantee ends when the loan is fully repaid.

When taking out a housing loan as a coupleWhen taking out a housing loan by combining the incomes of a married couple, the method of obtaining the group credit life insurance differs depending on the borrowing method: 1. Two individual mortgages with joint ownership and equal responsibility Each of a married couple will be covered by the group credit life insurance. In the event of the husband's death, the husband's loan balance will be repaid by the group credit life insurance, but the wife's loan balance will remain. 2. Combined income (joint ownership type with equal responsibility) Only the principal debtor is covered by the group credit life insurance. In most housing loans provided by private financial institutions, joint debtors are not eligible for the group credit life insurance. If something should happen to the principal debtor, the loan balance will be repaid by the insurance, but if something should happen to the joint debtor, the loan balance will remain and will be repaid only by the principal debtor. (Flat 35 allows a joint debtor to be covered by the group credit life insurance as well. Some financial institutions may also allow a joint debtor to be covered by the insurance.) 3. Combined income (guarantor mortgage type) Only the debtor is covered by the group credit life insurance. A guarantor is not covered by the insurance. If something should happen to the debtor, the remaining loan balance will be repaid by the insurance, but if something should happen to the guarantor, the loan balance will remain, and the debtor alone will be responsible for the repayment of it. |

2. Types and coverage details of Group Credit Life Insurance (Danshin)

While a standard Danshin covers death or severe disability, there are other types of Danshin with various special clauses that cover the event such that the insured becomes unable to work due to illness or injury. The followings are some of typical examples of such insurances.

| Standard Danshin (No special clause) |

When the housing loan debtor dies or becomes severely disabled, the insurance proceeds will be paid, and the loan balance will be paid off. There is no additional interest rate for insurance premiums. |

| Danshin with 3 major diseases coverage (with a special clause) |

In addition to a standard Danshin, this Danshin has a special clause that provides that if you develop one of the 3 major diseases (cancer, stroke, or acute myocardial infarction) and become ill as prescribed, insurance money will be paid, and your housing loan will be paid off. |

| Danshin with 8 major diseases coverage (with a special clause) |

The insurance benefits are paid when a person develops one of 8 diseases, including the 5 major lifestyle-related diseases (hypertension, diabetes, liver cirrhosis, chronic renal failure, and chronic pancreatitis), in addition to the said 3 major diseases, and becomes ill as prescribed. Eligible diseases and conditions vary depending on financial institution and product. |

A Danshin with a special clause generally adds 0-0.3% or so to the housing loan interest rate for the insurance premium. In this case, since the monthly payment amount will vary depending on the loan amount and repayment period, we recommend that you ask your financial institution to estimate how much your burden will increase due to the added interest rate.

The type of Danshin varies depending on the financial institution, so when selecting Danshin, make sure to check the details of the coverage, the conditions under which insurance benefits will be paid, and the timing of receiving the insurance benefits. For example, it is important to note that a special clause that reduces the loan balance to zero for a specified illness or disability may be covered immediately if the requirements are met, or it may not be covered unless the inability to work lasts for a certain period of time.

If you want to take out a housing loan but cannot be covered by Danshin

Even those who are unable to join Danshin due to past medical history or health reasons can take out Flat 35, which is a long-term fixed interest rate housing loan provided by the Japan Housing Finance Agency, because joining Danshin is optional for Flat 35. If you do not join Danshin with Flat 35, 0.2% will be deducted from the interest rate. If you choose to join Danshin, you will be required to pay a special contract fee (insurance premium) every year.

3. Points for selecting the group credit life insurance (Danshin)

Housing loans of private financial institutions require you to join Danshin, so when you take out a housing loan, it is a good time to review your insurance coverage. If you have already joined a life insurance, cancer insurance, medical insurance, etc., check to see if you are not paying unnecessary premiums, as their coverages may overlap with the coverage provided by the Danshin.

A housing loan Danshin is an insurance policy that can only be purchased at the time of taking out a housing loan, so the insurance premiums are likely to be less expensive than those for general medical insurances because it is more likely to be purchased by young, healthy people with a low risk of illness. In addition, the insurance benefit paid by Danshin is the amount equivalent to the outstanding balance of the housing loan at the time of the payment, making it less expensive than a general medical insurance policy with higher insurance benefit for lower premiums.

However, Danshin is an insurance that specializes in covering the repayment of a housing loan, so it is not an insurance policy to cover all living expenses. So please take care to ensure that you understand the features and coverage of Danshin and choose a type that fits your age, health condition, household budget, and your family’s future life plans

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.