Housing Loan Tax Deduction

Buying a home is the most expensive purchase experience for many of us, and housing market conditions have a significant impact on Japanese economy. Therefore, in Japan, various tax incentives have been taken for housing purchases in accordance with the economic and financial conditions of the country. A typical system of those is “Housing Loan Tax Deduction”. This system began in 1972 during Japan’s period of high economic growth with the introduction of “Tax Deduction System for Housing Acquisition” to support housing demands and has been revised repeatedly to the present day in response to changes in housing needs.

What is Housing Loan Tax Deduction?

This is the system that you can deduct 0.7% of the loan balance at the end of the year from income tax (partially from inhabitant tax of the following year) for up to 13 years, when you use a housing loan to build a new house, acquire, or renovate your home. If you cannot deduct it from your income tax, you can also deduct it from the following year’s inhabitant tax (up to 97,500JPY). With the tax reform in 2022, the eligibility period of this tax deduction system has been extended for 4 more years to 2025.

・0.7% of the loan balance at the end of the year is deducted from income tax.

・In principle, the deduction period is 13 years for newly built housing and 10 years for existing housing (preowned housing).

Brief Overview of Housing Loan Tax Deduction

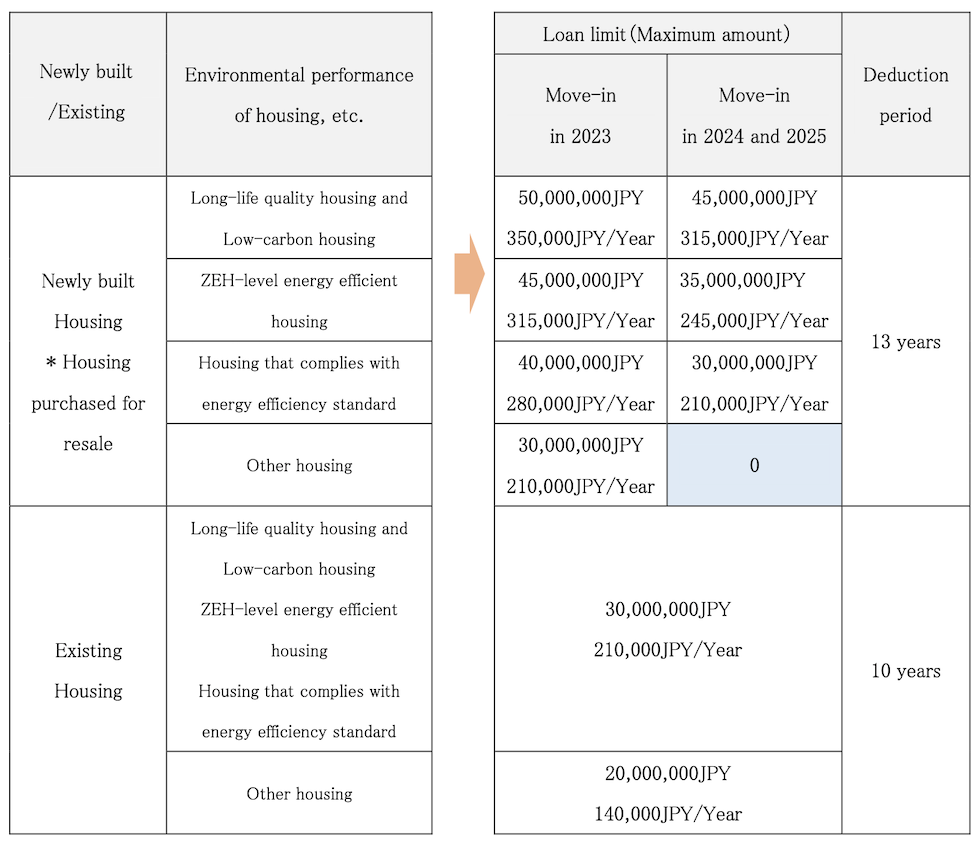

As shown in the table below, the loan amount limit and deduction period are determined depending on whether the home is newly built or existing (preowned), the environmental performance of the home, and of the time of move-in.

Please note that newly built homes that may have building certification after 2024 will not be eligible for Housing Loan Tax Reduction unless they come with good quality (housing that meets energy- conservation standards).

*What is Housing purchased for resale?

It is high-quality existing housing that has been renovated by a real estate company (real estate broker) that meets certain conditions, and it is eligible for the same tax deduction as for newly built housing.

It is defined as an existing housing that has been specifically expanded or renovated by a real estate broker and that is within 2 years from the date of acquisition by the real estate broker (At the time of acquisition, it must have passed 10 years or more since the date when the housing was newly built). The total amount of expenses required for construction related to the specific extensions and renovations, etc. should be more than the amount equivalent to 20% of the sales price (including tax) of the existing housing for individual buyers (or 3,000,000JPY if the amount exceeds 3,000,000JPY).

Terms and Conditions for Housing Loan Tax Deduction

1. You should live in the purchased housing for yourself (Housing for investment purposes is not eligible.)

2. The floor area should be 50m2 or more. In this regard to the newly built housing that has gained building certification by 2023, the floor area can be 40m2 or more and less than 50m2, only for those with a total annual income of 10,000,000JPY or less.

3. The total annual income should be 20,000,000JPY or less. When a married couple takes out a loan for couples, the total annual income of each should be 20,000,000JPY or less.

4. The repayment period of a housing loan should be 10 years or more.

5. Move into the housing must be within 6 months of delivery or completion of construction.

6. The housing should meet the new earthquake resistance standards.

7. In the case of the housing that will have building certification after 2024, it should meet certain energy-conservation standards.

How much can you get back with Housing Loan Tax Deduction?

The housing loan tax deduction is the system in which 0.7% of the loan balance at the end of the year is deducted, but the actual amount of deduction is calculated based on the loan balance, the borrowing limit of the purchased housing, the period of deduction, the amount of income tax paid, etc.

CASE1

Annual income: 8,000,000JPY

Purchase of newly built housing (Long-life quality housing) in 2022

->Borrowing Limit (maximum amount): 50,000,000JPY, Period of deduction: 13 years

Year-end loan balance in the 1st year of move-in: 53,500,000JPY (fixed interest rate:1.50%, repayment for 35 years)

Tax payment according to income: Income tax: 320,000JPY, Inhabitant tax: 390,000JPY

1. Loan balance x 0.7% = 53,500,000JPY x 0.7% = 374,500JPY

2. Maximum borrowing amount x 0.7% = 50,000,000JPY x 0.7% = 350,000JPY

3. Maximum amount based on tax payment amount: 320,000JPY + 97,500JPY = 417,500JPY

The lesser amount between 1 and 2, which is 350,000JPY, will be the refund amount for the 1st year. It exceeds 320,000JPY, which is the amount of income tax paid, but the maximum amount of 97,500JPY is deducted also from the amount of inhabitant tax paid, so the deduction amount will be 350,000JPY. The same calculation will be made after the 2nd year, but the year-end loan balance decreases year by year and falls below 350,000JPY, so the refund amount will become smaller year by year.

Total deduction amount for 13 years (estimate): 4,140,000JPY

CASE 2

Annual income: 6,000,000JPY

Purchase of existing housing (pre-owned housing) in 2022

->Borrowing Limit (maximum amount): 20,000,000JPY, Period of deduction: 10 years

Year-end loan balance in the 1st year of move-in: 38,000,000JPY (fixed interest rate:1.50%, repayment for 35 years)

Tax payment according to income: Income tax: 130,000JPY, Inhabitant tax: 250,000JPY

1. Loan balance x 0.7% = 38,000,000JPY x 0.7% = 266,000JPY

2. Maximum borrowing amount x 0.7% = 20,000,000JPY x 0.7% = 140,000JPY

3. Maximum amount based on tax payment amount: 130,000JPY + 97,500JPY = 227,500JPY

The lesser amount between 1 and 2, which is 140,000JPY, will be the refund amount for the 1st year. It exceeds 130,000JPY, which is the amount of income tax paid, but the maximum amount of 97,500JPY is deducted also from the amount of inhabitant tax paid, so the deduction amount will be 140,000JPY. The same calculation will be made after the 2nd year, and the total deduction amount will be 1,400,000JPY (140,000JPY x 10 years).

Total deduction amount for 10 years (estimate): 1,400,000JPY

Procedures to claim Housing Loan Tax Deduction

You should file a yearly tax return in the following year of your move-in. Housing Loan Tax Deduction is officially called “Special deduction for housing loans, etc.”.

Income taxes of employment income earners such as company employees are withheld at the company, but you need to file your own tax return for the 1st year. The filing period of the yearly tax return is from February 16th to March 15th, but if you file for the refund of housing loan deduction, you can file it from January. If you are self-employed and file a tax return every year, you should file it together with the regular yearly tax return. The refund amount will be transferred to your designated bank account approximately 1 month after completion of your filing procedures.

Documents required for claiming a tax deduction

|

Documents |

Obtained from |

| Tax return form | You can get it from the website of National Tax Agency. You can also get it from the website of a local Tax Office. |

| (Specific additions or improvement, etc.) Calculation statement of special deduction for housing loans, etc. | |

|

Copy of Identification documents(a or b) |

You can obtain it at a Municipal Office |

| Certificate of Real Property Registration | You can obtain it at a local Legal Affairs Bureau |

| Copy of Sale and Purchase Agreement (Service Contract) for Building and Land | Contract documents with a real estate company |

| Tax withholding certificate |

You can get it from your place of employment |

| “Certificate of the year-end balance of the loan” to certify the balance of Housing Loan | It will be sent from the financial institution where you took out a housing loan. |

|

(In the case of a pre-owned housing that meets certain earthquake resistance standards) Copy of Earthquake Resistance Certificate or Housing Performance Evaluation Report |

You can get it from the real estate company which you contracted with. |

|

(In the case of housing certified as Long-life quality housing and Low-carbon housing) Copy of Certification Letter |

If you are a company employee, after the 2nd year, you can complete the procedure at the company’s year-end tax adjustment. If you file a tax return in the 1st year, the tax office will send you “Application for Special deduction for housing loans, etc. “for the following years. Around the end of November, the financial institution will send you “Certificate of Year-end Balance of Housing Loan”. By submitting these documents together with the year-end tax adjustment, you can have Housing Loan Tax Deduction after the 2nd year. When you apply for Housing Loan Tax Deduction at the year-end tax adjustment, the refund amount is generally transferred to your designated bank account in the manner of an addition to your salary or bonus.

Those who file a tax return every year, such as those who are self-employed, will be required to file a tax return after the 2nd year.

*The above information is only a brief overview and does not guarantee the tax system, tax deductions, etc. For the details of actual tax system and tax deduction amount, please consult with your local tax office.

- Luxury Condominiums and Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses centering around the

Roppongi Hills and Tokyo Mid Town areas.