Pre-owned condominium apartments in the Tokyo Metropolitan Area – Trends and fluctuations in transaction prices in 2022

We have summarized here the transaction trends for the year 2022 of pre-owned condominium apartments in the Tokyo metropolitan area (Tokyo, Saitama, Chiba, Kanagawa) which is commutable to central Tokyo and the suburbs. The transaction prices are in an upward trend year by year, mainly due to low interest rates and rising construction costs in Japan.

Trends in transaction of pre-owned condominiums in the Tokyo Metropolitan Area

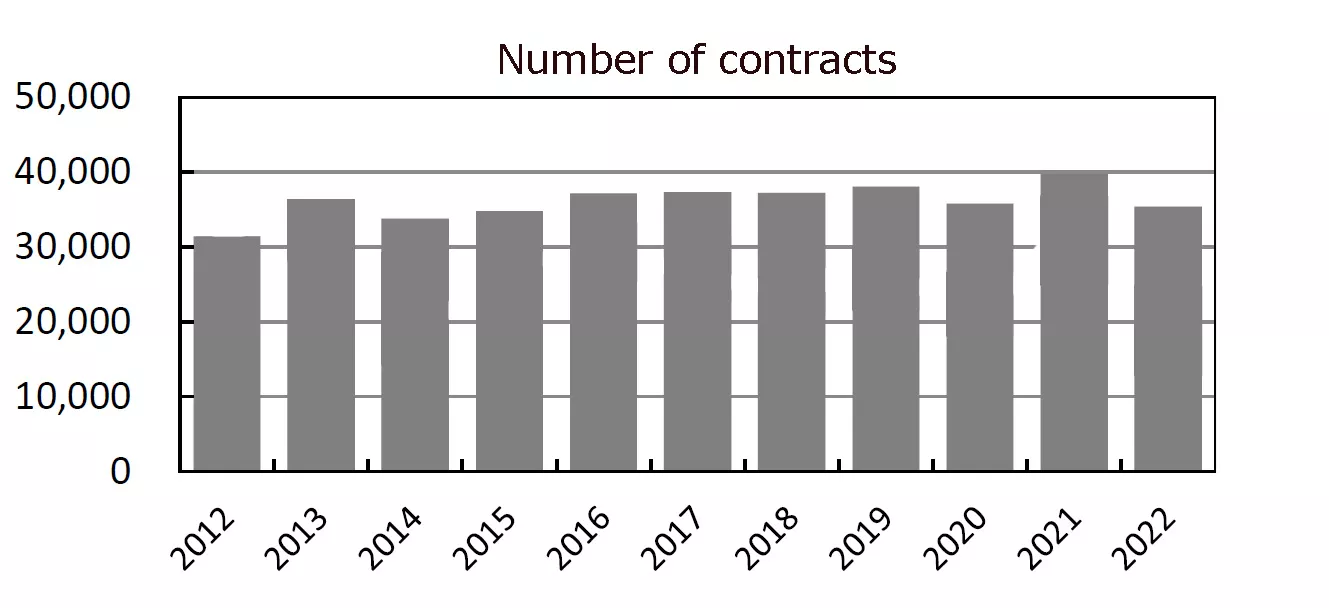

Number of contracts

In 2022 the number of contracts for pre-owned condominiums in the Tokyo metropolitan area was 35,429, which was declined (11%) from the year 2021 for the first time in 2 years.

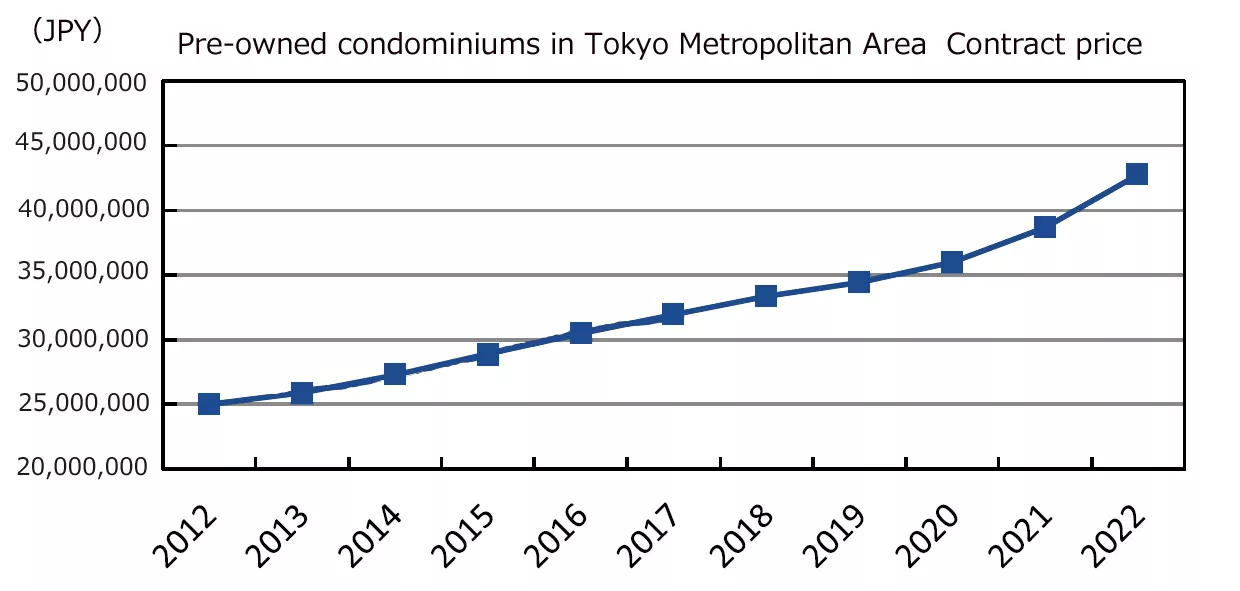

Price Trend

The average price of pre-owned condominiums sold in 2022 was 42.76 million yen (10.5% increase from the year 2021) and increase for 10th consecutive year. The average unit price per 1m2 was JPY672,400 (12.4% increase from the year 2021), which was also increase for 10th consecutive year, and has risen by 76.1% in the last 10 years. Looking at the price range, each price range over JPY50 million seems to be increasing in terms of the number of contracts and contract ratio.

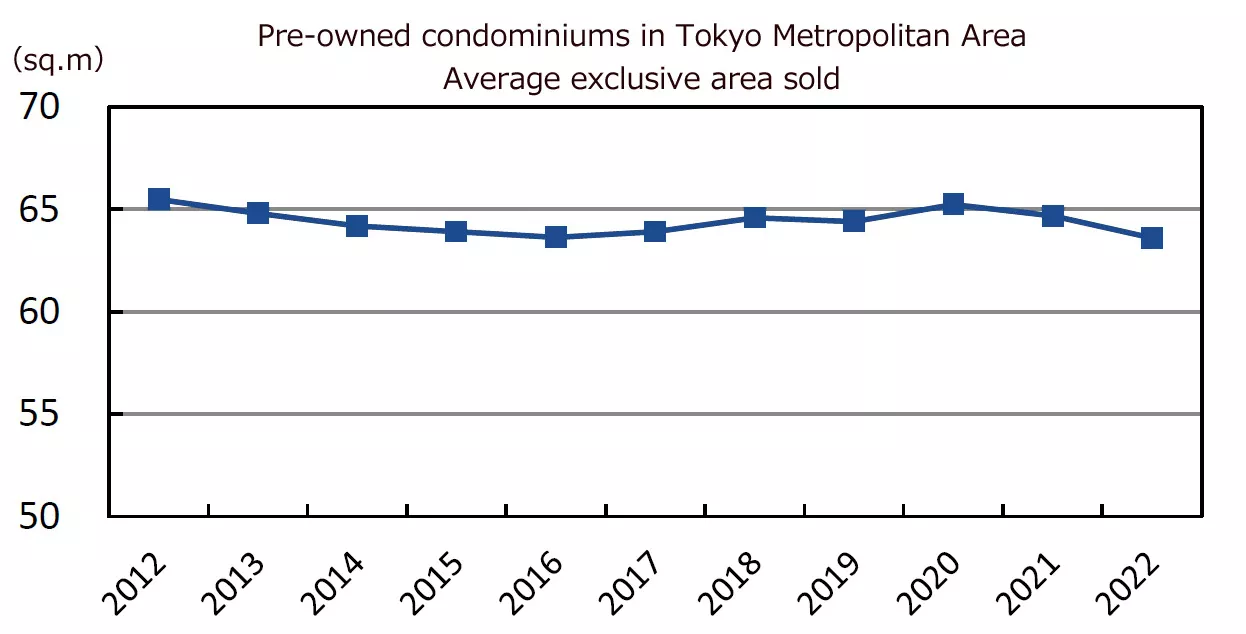

Average Exclusive Area

The average exclusive area of condominiums sold in 2022 was 63.59m2 (1.7% decline from the year 2021), shrinking for the 2nd consecutive year.

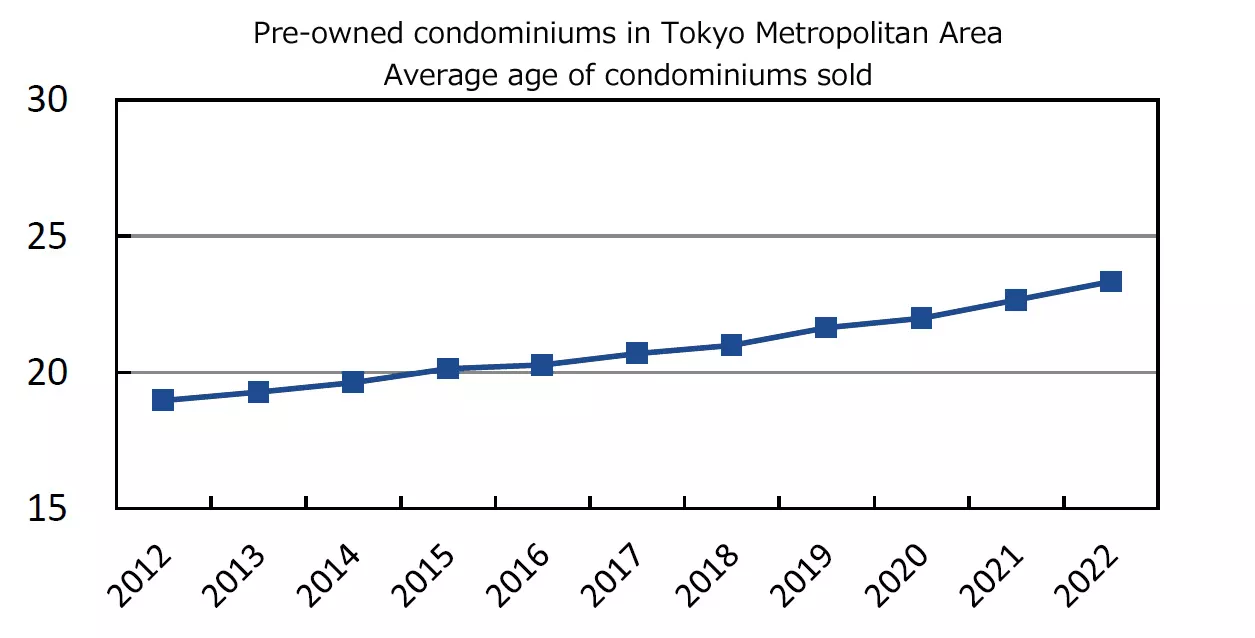

Average Age

he average age of condominiums sold in 2022 was 23.33years old (22.67years old in 2021), which is continuing to age.

Data: Real Estate Information Network System (REINS)

Price rise factors of pre-owned condominiums in Tokyo Metropolitan Area

Pre-owned condominium prices in the Tokyo metropolitan area continue to rise. The possible reasons for the price increase are as follows:

Continued low interest rates in Japan

With the lower interest rate of housing loans under the Government’s continued low interest rate policy in Japan, the number of prospective housing buyers increased.

Increased construction costs

Due to global inflation, corona disaster, war, etc., construction material costs are soaring, and due to labor shortages, labor costs are increasing.

Increase in investment from overseas and foreign buyers

Due to the significant depreciation of the Japanese yen in 2022, the number of foreigners who purchase real estate in Japan with foreign currency has increased. In addition to the trend of Japanese yen’s depreciation, the value of real estate in Tokyo is less expensive than that in other developed countries.

Increase in high-income households

The number of households called power couples who have an annual household income over JPY10 million and can purchase real estate is increasing among the younger generation. Purchases by wealthy people other than such younger generation are also increasing.

- Rental Apartments & Houses in Tokyo

- Listings of popular and luxurious rental apartments, condominiums, and houses designed with expats in mind.

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.