Overview of Japan's Inheritance Tax for Foreigners

This article is written by Thomas Y. Lu (Global Head of Tax) of Leo Wealth and Ryo "Ryan" Kubozono of financialplanning.jp.

The Japanese real estate market has been increasingly attracting foreign interest in recent years, particularly among foreigners residing in Japan or non-residents who are considering purchasing real estate in Japan or already own real estate here. The weakening of the yen has significantly accelerated such interest. While the cost of the property may be attractive, the buyer and their family should also think about the exposure to the Japanese inheritance tax system before making their decision.

In this article, we would like to provide an overview of the Japanese inheritance tax system, then go over the inheritance tax implications that the heirs will face upon death of a Japanese property owner.

In subsequent articles, we will also explore the various exit strategies, such as sales and gifting.

1. Inheritance Procedures and Flow

Assets subject to inheritance tax include tangible, intangible, real, or personal property, unless otherwise specifically exempt under the law. The asset is valued in accordance with the provisions of the Japanese tax rules. The same rules apply to the gift tax system.

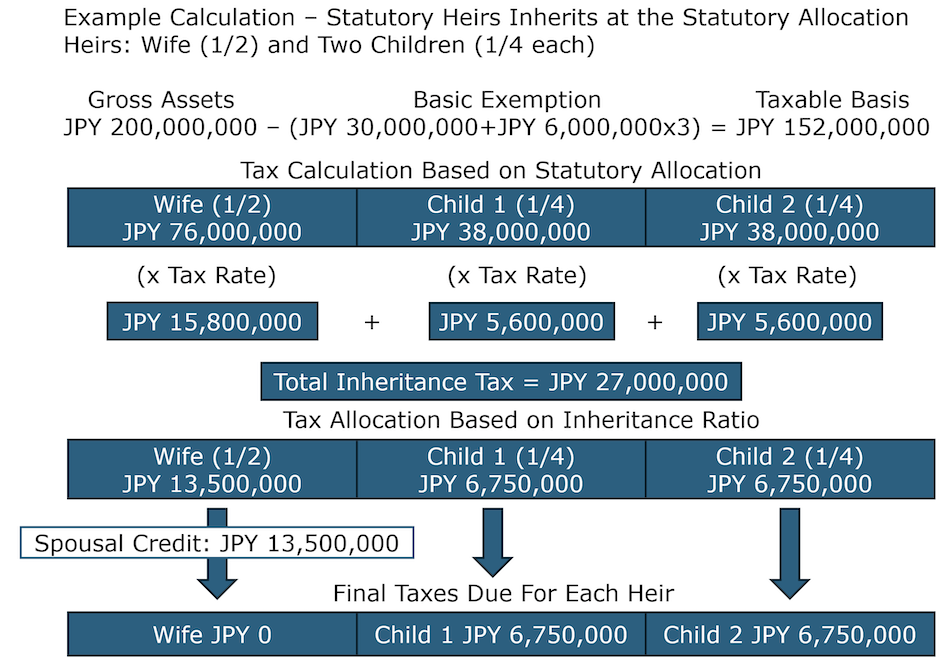

In Japan, it’s not the estate that’s taxed, but the heirs themselves—and the number of heirs factors heavily into the overall calculation. The total amount due is calculated based on the statutory amount due to each heir, regardless of whether the heir receives that amount or not—so you also can’t fudge the totals by writing people out of a will. The final payment is divided among the actual recipients, so even if the will cuts someone out, it’s the recipients who have to pay the tax amount.

While it is possible to file separate inheritance tax returns, it is customary that one inheritance tax return is filed for all heirs. The filing deadline is 10 months after the date of death, or 10 months after the date that you learned that you have an inheritance tax filing requirement.

Heirs who have acquired real estate in Japan by inheritance are required to apply for inheritance registration within 3 years from the date of knowing that he/she has acquired such ownership.

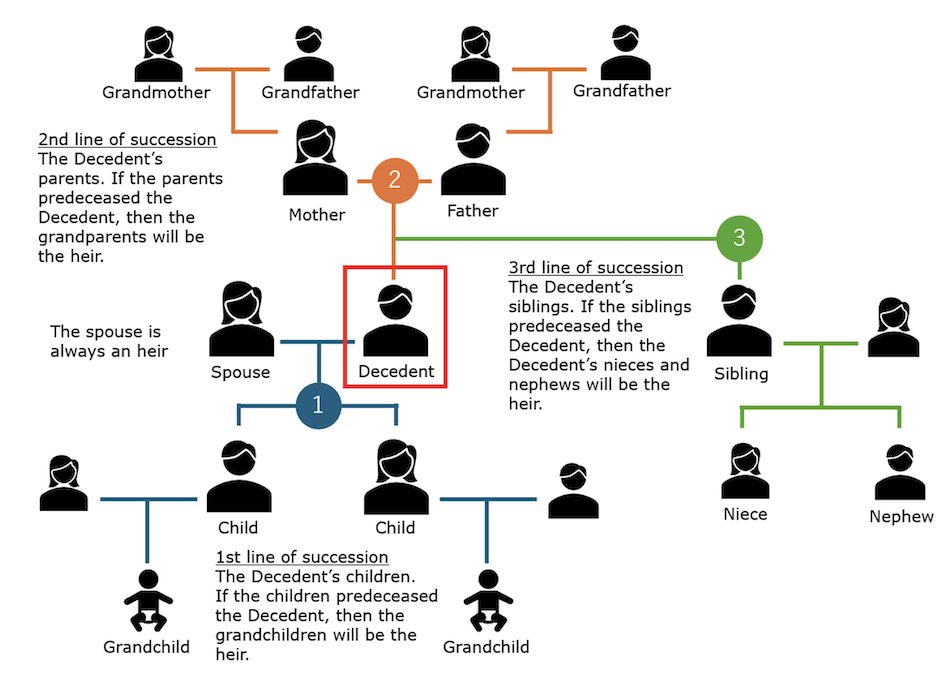

2. Scope of statutory heirs

Statutory heirs always include the surviving spouse. It is generally not possible to disinherit your spouse.

Aside from your spouse, the following succession rules apply.

First line of succession: Your Children

・Including adopted and biological children

・Illegitimate children born outside of the marriage generally have the same inheritance rights as legitimate children.

Second line of succession: Your Parents

・If your parents have pre-deceased you, then the rights to your inheritance go to your grandparents, and if your parents and grandparents have already passed away then the rights to your inheritance go to your great-grandparents.

Third line of succession: Your Siblings

・If your siblings have pre-deceased you, then your inheritance is passed on to your nieces or nephews.

If you die without heirs, the court will appoint an administrator of inherited property to manage your estate and determine heirship and asset distribution.

The following table illustrates several possibilities resulting from application of the civil code to the distribution of a decedent's assets when there is a surviving spouse:

| Statutory inheritance shares | ||

| Statutory heirs | Statutory share of spouse | Statutory share of non-spouse heirs |

| Spouse only | 100% | - |

| Spouse and children | 1/2 | 1/2 |

| Spouse and parents | 2/3 | 1/3 |

| Spouse and decedent's siblings | 3/4 | 1/4 |

Below is an illustration outlining the order of succession as described above.

IMPORTANT: The scope of taxation for the heir depends on several factors, which will be covered in depth in the second section detailing international inheritance.

3. Inheritance tax calculation method

Once the number and nature of statutory heirs is determined, the aggregated tax base (i.e. gross value of assets subject to inheritance tax less deductions) is then divided among all statutory heirs, and the inheritance tax rate in the table below is applied to each total. Thus, the tax rate is not applied to the gross aggregated tax base, but to the fraction received by each heir—meaning you will likely face lower rates, assuming there is more than one statutory heir.

| Inheritance tax rates | ||

| Amount received as statutory inheritance share | Tax rate | Deduction |

| ¥10,000,000 and below | 10% | - |

| Over ¥10,000,000 to ¥30,000,000 | 15% | ¥500,000 |

| Over ¥30,000,000 to ¥50,000,000 | 20% | ¥2,000,000 |

| Over ¥50,000,000 to ¥100,000,000 | 30% | ¥7,000,000 |

| Over ¥100,000,000 to ¥200,000,000 | 40% | ¥17,000,000 |

| Over ¥200,000,000 to ¥300,000,000 | 45% | ¥27,000,000 |

| Over ¥300,000,000 to ¥600,000,000 | 50% | ¥42,000,000 |

| Over ¥600,000,000 | 55% | ¥72,000,000 |

4. Various deductions

Some of the major basic exemptions are listed below.

Basic exemption

The amount of basic exemption is JPY 30 million plus JPY 6 million multiplied by the number of statutory heirs

Life Insurance

The amount of exemption is JPY 5 million multiplied by the number of statutory heirs

Mortgages on real estate

Mortgage from real estate properties can be deducted from the assessed property value. Thus, if you have a large amount of mortgage and pass it on to your heirs, you can get a very low or negative property value when it comes to gift or inheritance taxes.

Minors credit

JPY 100,000 multiplied by the heir’s age for minor heirs under the age of 18.

Disability credit

JPY 100,000 multiplied by the heir’s age for heirs with disabilities (JPY 200,000 for special disabilities).

Foreign tax credit

A foreign tax credit may be available if the same asset is also taxed in other tax jurisdictions.

Spousal credit

The spousal credit for the Japanese inheritance tax is limited. The spousal credit would mean no Japanese inheritance tax will be imposed on amounts that the spouse receives up to the greater of: (1) the spouse’s statutory share of the total taxable assets (typically 1/2), and (2) JPY 160 million.

A sample case for a gross inheritance of JPY 200,000,000 with three heirs (wife and two children):

5. Valuation of Assets

Assets are generally valued at the fair market value on the date of death. However, there are special tax valuation rules for certain assets, of which real estate based in Japan is a notable one.

The land valuation uses a roadside land valuation, known as Rosenka in Japanese. The Japanese National Tax Agency publishes this value on July 1, and is renewed once in 3 years. This roadside land valuation is said to be roughly 80% of fair market value, but even more discount is available for the land depending on size and usage.

The property valuation for tax purposes is equivalent to its property tax assessment value, which is roughly 70% of fair market value. Thus, Japanese real estate is considered a key component in Japanese estate tax planning due to its reduced tax valuation.

6. Considerations for Foreign Nationals

While we covered the basic mechanism of the inheritance tax system today, foreign nationals may have other options to explore.

Generally, a directly held real estate will be considered a Japan situs asset, therefore subject to the Japanese inheritance tax upon the owner’s death. The applicability of the Japan inheritance tax to other assets held by the owner will be dependent on the owner’s/heir’s domicile, nationality, Japan visa type, and time spent in Japan on the date of death.

For non-resident individuals who will have no ties to Japan aside from real estate, one planning idea to consider would be to set up an offshore entity to purchase the Japan property. That way, the property is owned by a non-Japan entity, and thus making this a non-Japan situs asset.

If you have any questions about this article or if you would like to learn more about how a purchase of real estate will impact you, please contact Leo Wealth.

監修者:佐藤税務事務所 税理士 佐藤大悟

Article Supervisor: Daigo Sato, Certified Public Tax Accountant, SATO Tax Advisory Services

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.