Japan's Real Estate Market Trends in 2022

Every month, the "Japan Property Price Index" is published by the Ministry of Land, Infrastructure, Transport, and Tourism. We will explain the trends in 2022 based on the most recent version (which was published on November 30, 2022).

"Japan Property Price Index" is calculated based on information of approximately 300,000 real estate transaction prices in the past. The sources of information are from questionnaire surveys of people who have bought and sold real estate, mobility information of real estate registration, and field surveys by real estate appraisers.

*There is a 3 month delay between the date of release and the target period, so the data is not being released in real time. (For instance, data made public on November 30, 2022, covers August 2022.)

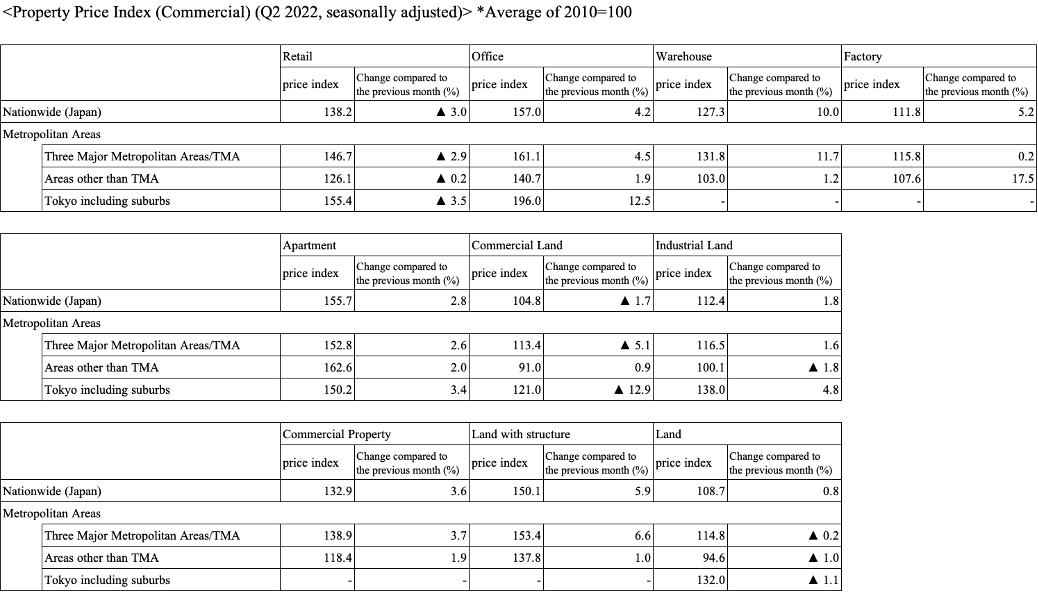

1. Japan Commercial Property Price Index (JCPPI) by Usage

Data source:Ministry of Land, Infrastructure, Transport and Tourism

Data source:Ministry of Land, Infrastructure, Transport and Tourism

Data source:Ministry of Land, Infrastructure, Transport and Tourism

Data source:Ministry of Land, Infrastructure, Transport and Tourism

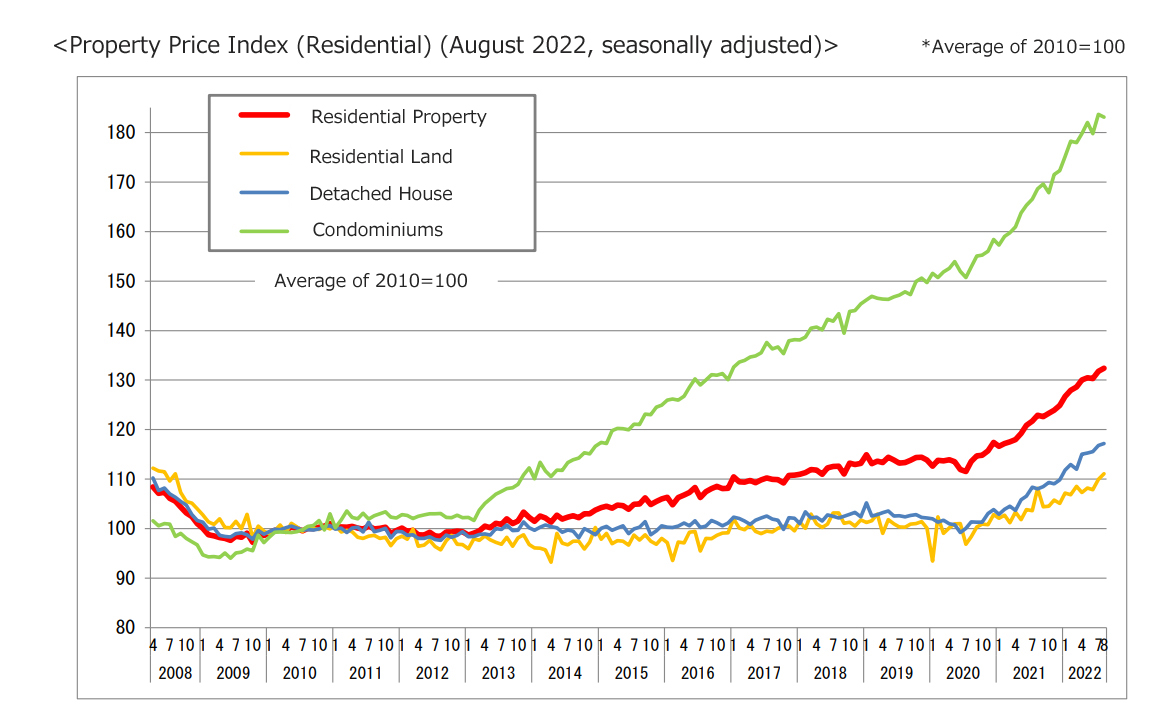

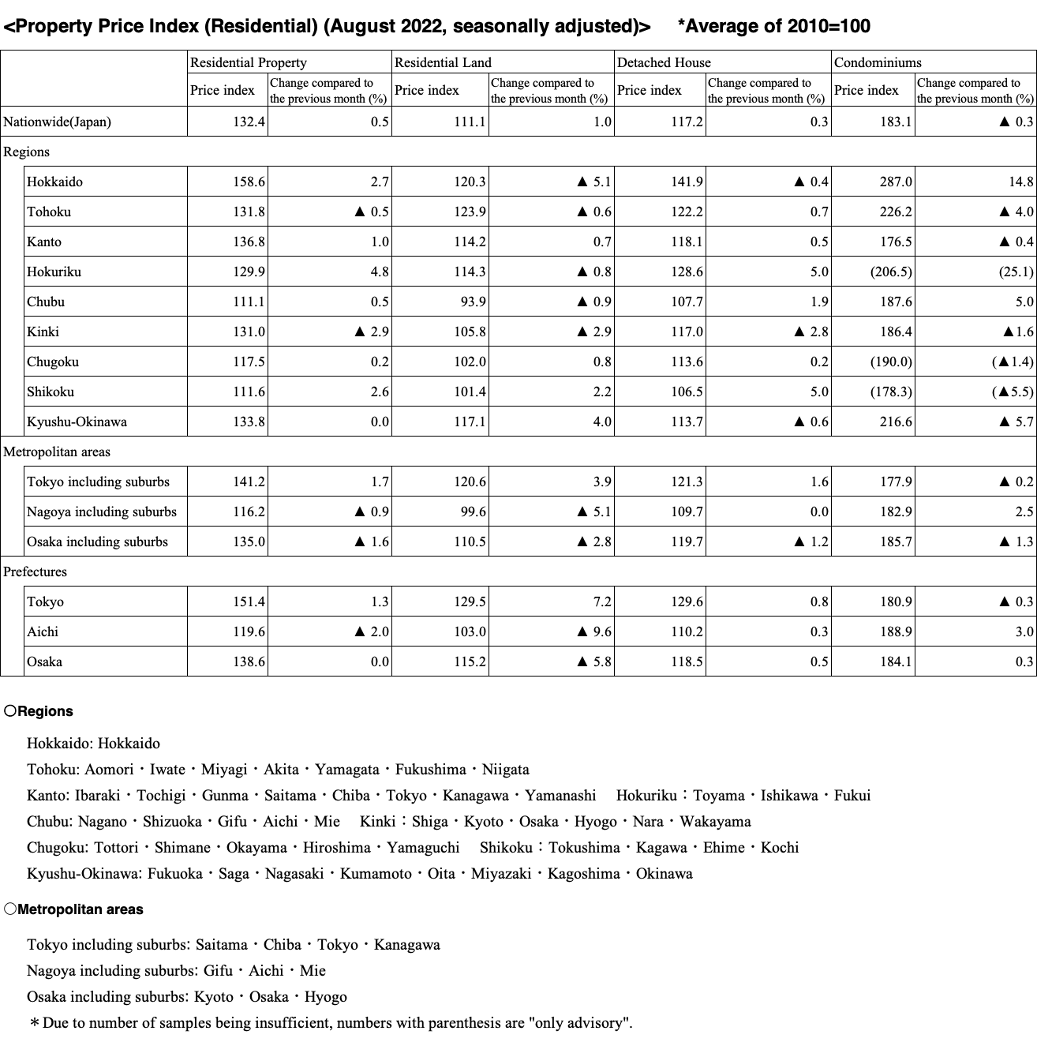

Price Trends of Residential Land

The price has remained almost flat after the base year of 2010, while once fell below the standard value of 100 in January 2020, but has been on an upward trend since then, and is still on an upward trend in 2022 although showing a slight fluctuations.

Looking at the month-on-month change by region (comparison between July and August 2022), the Hokkaido, Kinki Region, Tohoku, Hokuriku, Chubu, and Kinki have seen lower prices than those in the previous month, but those in the Kyushu and Okinawa regions have gone up 4%.

Price Trends of Detached House

Like residential Land, the price remained almost flat after 2010, but started to rise after 2020. The rate of increase is greater than that in Residential Land.

Looking at the month-on-month change by region (comparison between July and August 2022), the Hokkaido, and Kyushu-Okinawa regions have seen lower prices than those in the previous month, but those in the Hokuriku and Shikoku regions have gone up 5%.

Price Trends of Condominiums

The price started to rise in 2013 and has been rising significantly since 2020 - rising more than 1.8 times from 2010 to 2022.

When looking at the month-on-month change by region (comparison between July and August 2022), the national average value has decreased slightly, and when looking at it by region, it has decreased as a whole except for the price in Hokkaido and Chubu. However, since it is only a monthly aggregated data, it is necessary to pay close attention to the reports from next month onwards to determine the market trends.

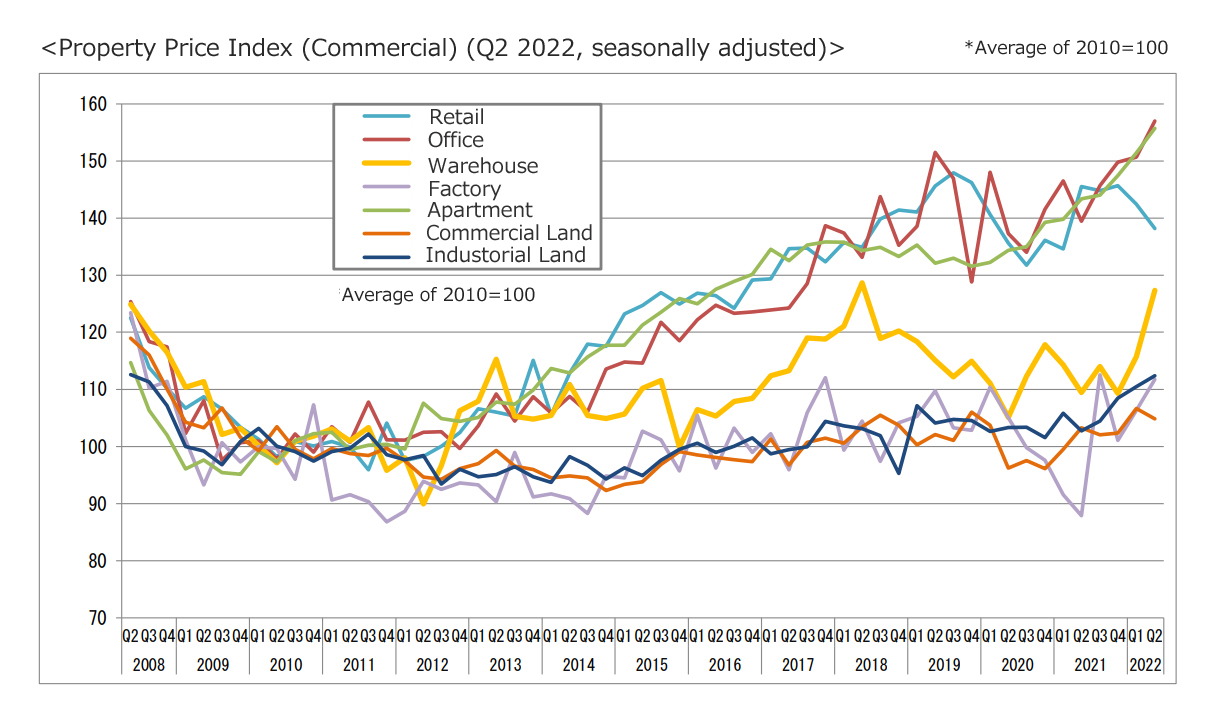

Japan Commercial Property Price Index (JCPPI) by Usage

Data source:Ministry of Land, Infrastructure, Transport and Tourism

Data source:Ministry of Land, Infrastructure, Transport and Tourism

Price Trends of Retail, Apartment (one building), and Office

The prices increased generally after 2012 although having upward and downward fluctuations during the period.

In 2022, The price of Retail has seen on a downward trend while that of Office and Apartment has seen on an upward trend. The change compared to the previous period by region has seen similar trend to the change nationwide while the price of Office has seen 12.5% increase in Tokyo including suburbs.

Price Trends of Warehouse

The price started to rise after 2015 and reached the highest ever in 2018, then declined after that, but started to rise again from 2021. In the second quarter in 2022, it has risen to almost the same level high as that in 2018 and has been continuing to rise since then.

Price Trends of Factory

Although the price dropped considerably in the first half of 2021, it started to rise around the end of 2021 and is continuing to rise in 2022.

Price Trends of Commercial Land

The price remained almost flat but was rising little by little after 2020. In 2022, it has started to decline a bit from the first quarter. In Tokyo including suburbs the price has seen -12% (comparison between the first and second quarter of 2022), and in Three Major Metropolitan Areas the price has seen -5.1%.

Price Trends of Industrial Land

The price remained almost flat after 2016, but it started to rise in 2021 and is rising in 2022. About the change compared to the previous period (comparison between the 1st and 2nd quarter of 2022), Tokyo including South Kanto Region has seen the largest increase rate of 4.8%.

Summary of Japan's Real Estate Market Trends in 2022

As the above table shows, housing-related sales in 2022 were on an upward trend although they fluctuated slightly. The price of commercial real estate is also on an uptrend excluding that of Retail and Commercial Land.

Japan Property Price Index is released every month, so you can update the latest market trends by checking it regularly. In addition, by using the Ministry of Land, Infrastructure, Transport and Tourism's search system "Land General Information System", which is also the source of Japan Property Price Index, you can search and browse the actual real estate transaction price, public notice of land prices, and prices based on prefectural land price survey, by specifying the area you want to know.

However, you have to understand that the data is not necessarily accurate because the information is created based on questionnaires to people, who have conducted real estate transactions, and the transactions may be few in some areas and regions.

【Land General Information System】

https://www.land.mlit.go.jp/webland_english/servlet/MainServlet(English)

https://www.land.mlit.go.jp/webland/(Japanese)

- Rental Apartments & Houses in Tokyo

- Listings of popular and luxurious rental apartments, condominiums, and houses designed with expats in mind.

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.