I want to give up inherited land! - About the System of Vesting of Inherited Land in the National Treasury

The System of vesting of inherited land in the national treasury is a system that allows you to request the government to take over the land in Japan that you do not want to inherit, due to reasons such as not planning to use it yourself, difficulty in renting or selling, or saving time and cost in maintenance and management, only if certain requirements are met. (Effective April 27, 2023)

*Official Name: “Act on Vesting of Land Ownership Acquired through Inheritance or Bequest in the National Treasury”

Purpose of Establishment

If you do not want to inherit real estate, there is a means called “Renunciation of Inheritance”. However, in "renunciation of inheritance," not only the real estate to be relinquished but also all assets such as deposits, savings, and stocks are subject to renunciation. Therefore, many people avoided renunciation of inherited land, but did not register such inherited real estate.

(*Application for inheritance registration was previously optional but has become obligatory as of April 1, 2024.

Inheritance registration of real estate is now obligatory! Please visit here. )

As a result, the number of lands whose owners are unknown, or "Lands with unknown owners" has increased. "Lands with unknown owners" are not properly managed, which lead to degradation of the environment and hinders disaster prevention measures and effective use of land. Therefore, the law has been enacted to prevent the occurrence of such cases.

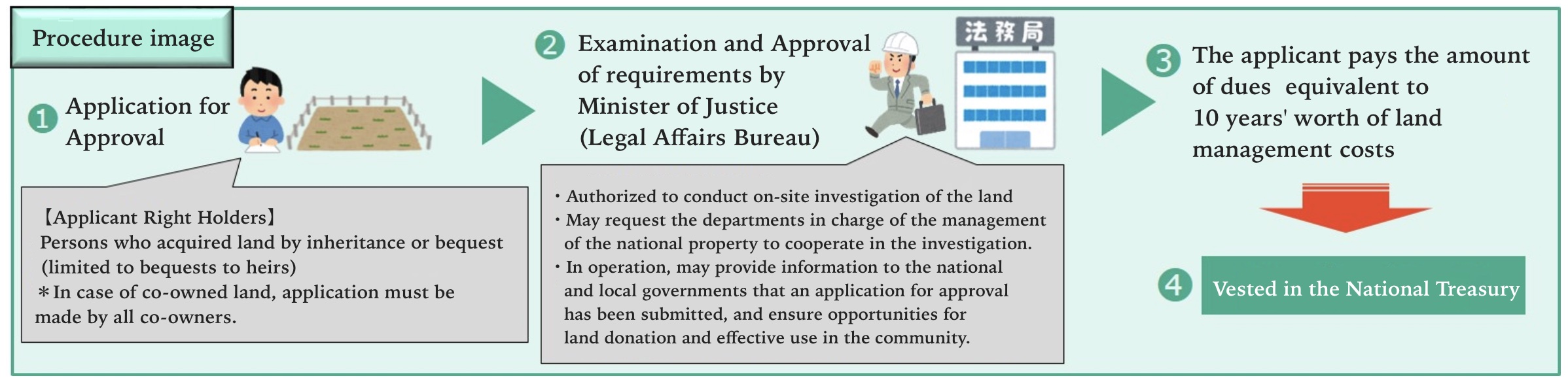

Flow of Procedures

Source: Ministry of Justice: Outline of Vesting of Inherited Land in the National Treasury

Details of the System

1. Who can apply?

- Heirs who acquired ownership of land by inheritance or bequest.

*Heirs who received a gift before death, persons who acquired the land themselves through purchase or other means, and corporations are not eligible to apply.

*Persons who acquired the land by inheritance or bequest before April 27, 2024, are also eligible.

*If the land is co-owned, application must be made by all co-owners.

2. Land that can be taken over

There are conditions for land that can be vested in the national treasury, and land that falls under any of the following categories will not be taken over.

(1) Requirements of Rejection (The land that will be immediately rejected at the application stage)

A: Land with buildings on it.

B: Land on which a security interest or the right to use for profit has been established.

C: Land that is scheduled for use by others.

D: Land with soil contamination.

E: Land where the boundary is not clear, or where there is a dispute over the existence or non-existence of ownership or the extent of ownership.

(2) Requirements of Disapproval (land that will be disapproved after application if determined to fall under any of the categories)

A: Land with cliffs of a certain inclination and height that require excessive cost and effort to manage.

B: Land with tangible objects on the ground that interfere with the management and disposal of it.

C: Land with tangible objects underground that must be removed for land management and disposal.

D: Land that cannot be managed or disposed of without a dispute with the owner of adjacent land, etc.

E: Other land that requires excessive costs and labor for normal management and disposal.

3. Fee for application

14,000 yen is required per parcel of land.

*One parcel: A unit of land in the land register that represents a single piece of land (not the actual area of the land).

After payment, the fee will not be refunded even if the application is withdrawn or is rejected or disapproved as a result of the examination.

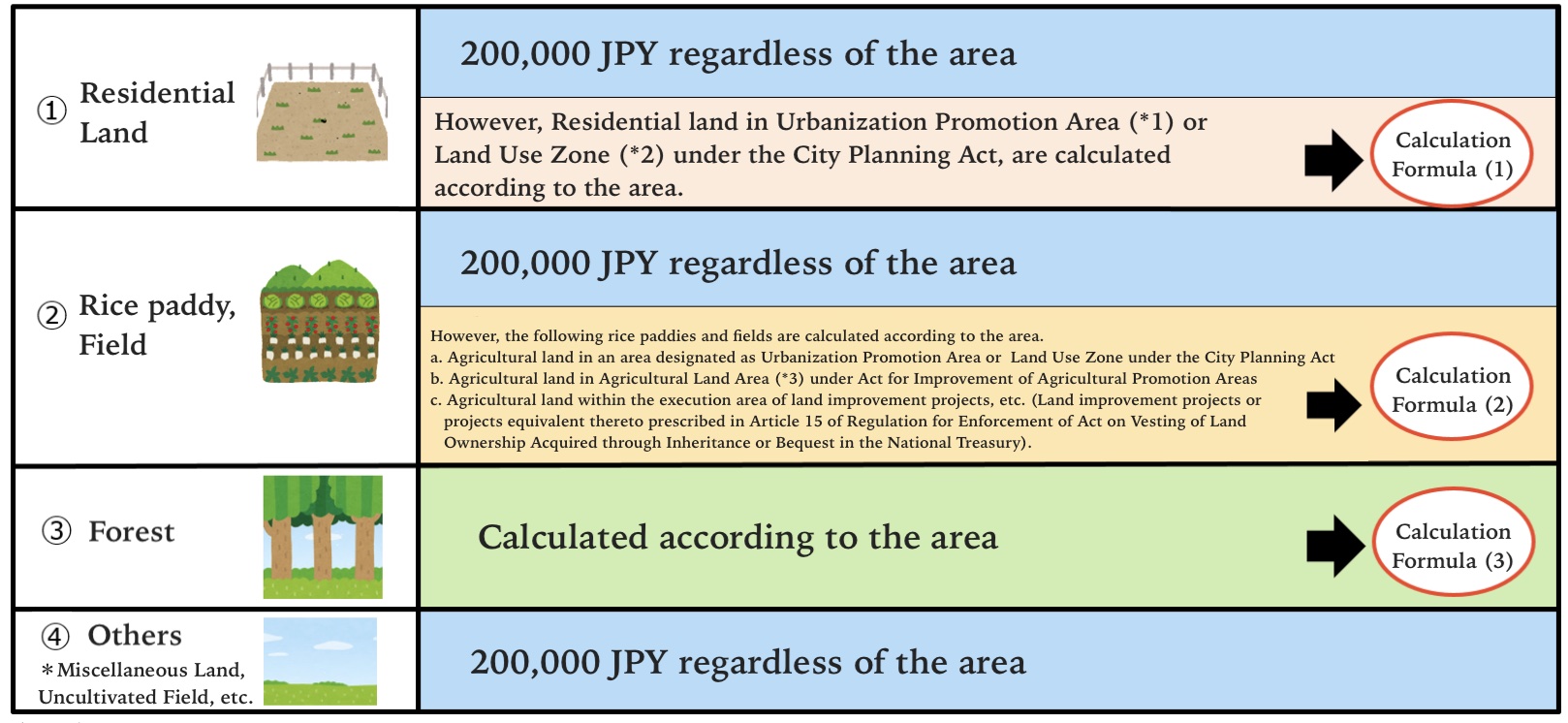

4. Payment of Dues

If approval is granted for vesting in the national treasury, the amount of money necessary for management of the land must be paid. The amount varies depending on the type of land, etc. and is calculated in the following manner.

*Payment must be made within 30 days from the day after receipt of the approval documents.

Specific examples of calculating the dues

(*1) Urbanization promotion areas are those areas where urban areas have already formed and those areas where urbanization should be implemented preferentially and in a well-planned manner within approximately the next 10 years. (Article 7, Paragraph 2 of City Planning Act (Act No. 100 of 1968)).

(*2) Land Use Zone is one of the regional districts under the City Planning Law and refers to an area where land use is defined as a general framework for urban areas, such as residential, commercial, and industrial areas (Article 8, Paragraph 1, Item 1 of City Planning Act).

(*3) Agricultural Land Areas are the designated areas where it is deemed necessary to comprehensively promote agriculture in consideration of various natural, economic, and social conditions (Article 8, Paragraph 2, Item 1 of Act on the Development of Agricultural Promotion Areas (Act No. 58 of 1969)).

If the land falls under formula (1) through (3) in table 1, the dues are calculated based on the calculations in the following table.

Calculation Formulas

(1) Residential land in Urbanization Promotion Area (*1) or Land Use Zone (*2) under the City Planning Act

| Area classification | Amount to be paid |

| 50m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 4,070 (JPY/m2) and adding 208,000JPY |

| More than 50m2 but 100m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 2,720 (JPY/m2) and adding 276,000JPY |

| More than 100m2 but 200m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 2,450 (JPY/m2) and adding 303,000JPY |

| More than 200m2 but 400m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 2,250 (JPY/m2) and adding 343,000JPY |

| More than 400m2 but 800m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 2,110 (JPY/m2) and adding 399,000JPY |

| More than 800m2 | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 2,010 (JPY/m2) and adding 479,000JPY |

(2) Land that is mainly used for agricultural purposes and is listed in any of the following:

a. Agricultural land in an area designated as Urbanization Promotion Area or Land Use Zone under the City Planning Act

b. Agricultural land in Agricultural Land Area (*3) under Act for Improvement of Agricultural Promotion Areas

c. Agricultural land within the execution area of land improvement projects, etc. (Land improvement projects or projects equivalent thereto prescribed in Article 40, items 1 and 2 (a) or (b) of Regulation for Enforcement of Cropland Act).

| Area classification | Amount to be paid |

| 250m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 1,210 (JPY/m2) and adding 208,000JPY |

| More than 250m2 but 500m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 850 (JPY/m2) and adding 298,000JPY |

| More than 500m2 but 1,000m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 810 (JPY/m2) and adding 318,000JPY |

| More than 1,000m2 but 2,000m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 740 (JPY/m2) and adding 388,000JPY |

| More than 2,000m2 but 4,000m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 650 (JPY/m2) and adding 568,000JPY |

| More than 4,000m2 | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 640 (JPY/m2) and adding 608,000JPY |

(3) Land that is mainly used as forest

| Area classification | Amount to be paid |

| 750m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 59 (JPY/m2) and adding 210,000JPY |

| More than 750m2 but 1,500m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 24 (JPY/m2) and adding 237,000JPY |

| More than 1,500m2 but 3,000m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 17 (JPY/m2) and adding 248,000JPY |

| More than 3,000m2 but 6,000m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 12 (JPY/m2) and adding 263,000JPY |

| More than 6,000m2 but 12,000m2 or less | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 8 (JPY/m2) and adding 287,000JPY |

| More than 12,000m2 | The amount obtained by multiplying the area of the land (to be vested in the national treasury) by 6 (JPY/m2) and adding 311,000JPY |

Summary

A new law has been enacted that allows you to give up only unnecessary land without giving up inheritance, but the burden of time and cost involved in vesting it in the national treasury is not small. Furthermore, the permission is only granted for the land that meets fairly strict conditions. If the land meets such strict conditions, it may be possible to earn income by leasing or selling the land without vesting it to the national treasury. We recommend that you first ask a reliable real estate company for an appraisal, confirm the asset value, and then decide whether or not to apply for vesting it in the national treasury. We also recommend that you consult with a lawyer, judicial scrivener, or other specialist when applying for it.

- Rental Apartments & Houses in Tokyo

- Listings of popular and luxurious rental apartments, condominiums, and houses designed with expats in mind.

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.