Loan for Home Renovation

In recent years, there has been a growing trend of people purchasing preowned properties for renovation when buying a house. In Japan, many individuals opt for housing loans when buying a house, but loans are also available for covering renovation costs. Here, we provide guidance on the process, financial planning, and the use of loans when purchasing a used property for renovation.

How much does it cost to renovate?

Generally, renovation refers to “replacement of equipment such as kitchen, bathroom, and toilet, etc.”, “house extensions”, and “house repairs”. Specific renovations include replacing wallpaper, flooring and other materials, replacing kitchen, bathroom and other water-related facilities, repairing leaks, changing the layout of the house, and many others.

This is an estimate of the cost and construction time for a typical renovation. Knowing the costs of renovation in advance will make it easier for you to set up a financial plan for the renovation together with the purchase of a house. Also, if you are renovating a house immediately after purchasing it, you will move in the house after the renovation work is completed. So, it is a good idea to know the approximate number of days it will take for the renovation work to be completed.

| Renovation Areas | Cost Estimate | Construction Duration |

| Kitchen | 900,000~1.500,000JPY | 6days ~ 2-3weeks |

| Bathroom | 1,000,000~1,500,000JPY | 3~7days |

| Toilet | 150,000~400,000JPY | 3~7days |

| Vanity room | 100,000~400,000JPY | 1~4days |

| Replacement of wallpaper cloth 16.56m2 room (wall area: approx. 45 m2) |

50,000~100,000JPY | 2~3days |

| Replacement of flooring materials 33.12m2 room (floor area: approx. 33 m2) |

200,000~500,000JPY | 2~6days |

This information is for reference only, as it varies depending on the scope of the renovation, the grade of the product, the renovation contractor, etc.

How to take out a loan to pay for renovation

Many financial institutions offer “housing loans” to finance the construction or purchase of new housing, as well as renovation loans specifically for renovation costs.

Renovation loans are completely different products from housing loans and are unsecured loans. Therefore, compared to housing loans that are secured by the house to be purchased, the loan amount is lower, the interest rate is higher, and the repayment period is shorter.

Comparison of Housing loan and Renovation loan

| Housing loan | Renovation loan | |

| Purpose of loan | Funds for construction of new house or purchase of housing property | Funds for renovation costs |

| Collateral | A mortgage is placed on the purchased property | Not required |

| Loan screening | Screening is strict and borrowing takes 2-3 weeks | It takes 1 day to 1 week Less screening and less time to borrow |

| Loan amount | Higher amount, e.g. up to 100 million JPY, up to 300 million JPY | Lower amount, e.g. 5-15 million JPY |

| Interest rates | Lower rate Floating rate:0.5~1.0% |

Higher rate Floating rate:2.0~4.0% |

| Repayment period | Up to 35 years | Up to 10-15 years |

| Housing loan tax deduction | Deductible | Not deductible |

“Loan for home purchase with renovation” is recommended

Several financial institutions offer a product called “Loan for home purchase with renovation “, which allows borrowers to finance the funds for both buying and renovating a house. It is a product that you can borrow the funds including the cost of renovation when taking out a housing loan for purchase of a house. Since it is handled as a housing loan, the interest rate is lower, and the repayment period is longer. Compared to taking out a housing loan and a renovation loan separately, this loan is consolidated into one loan, making it easier to set up a repayment plan and reduce various expenses. If you are planning to buy a pre-owned house and renovate it immediately, we recommend that you consider it because it has many advantages.

Financial institutions offering “Loan for home purchase with renovation”

For housing loans with long-term fixed interest rates, Japan Housing Finance Agency provides “Flat 35 Renovation”, while private financial institutions also offer a variety of products, including housing loans with variable interest rates and 10-year fixed rates.

・SBI Shinsei Bank / Renovation funds

・Mizuho Bank / Housing loan for the purchase and renovation of an existing house (Japanese)

・Sumitomo Mitsui Housing Loan (various expenses and renovation account) (Japanese)

Points to note on the use of “Loan for home purchase with renovation”

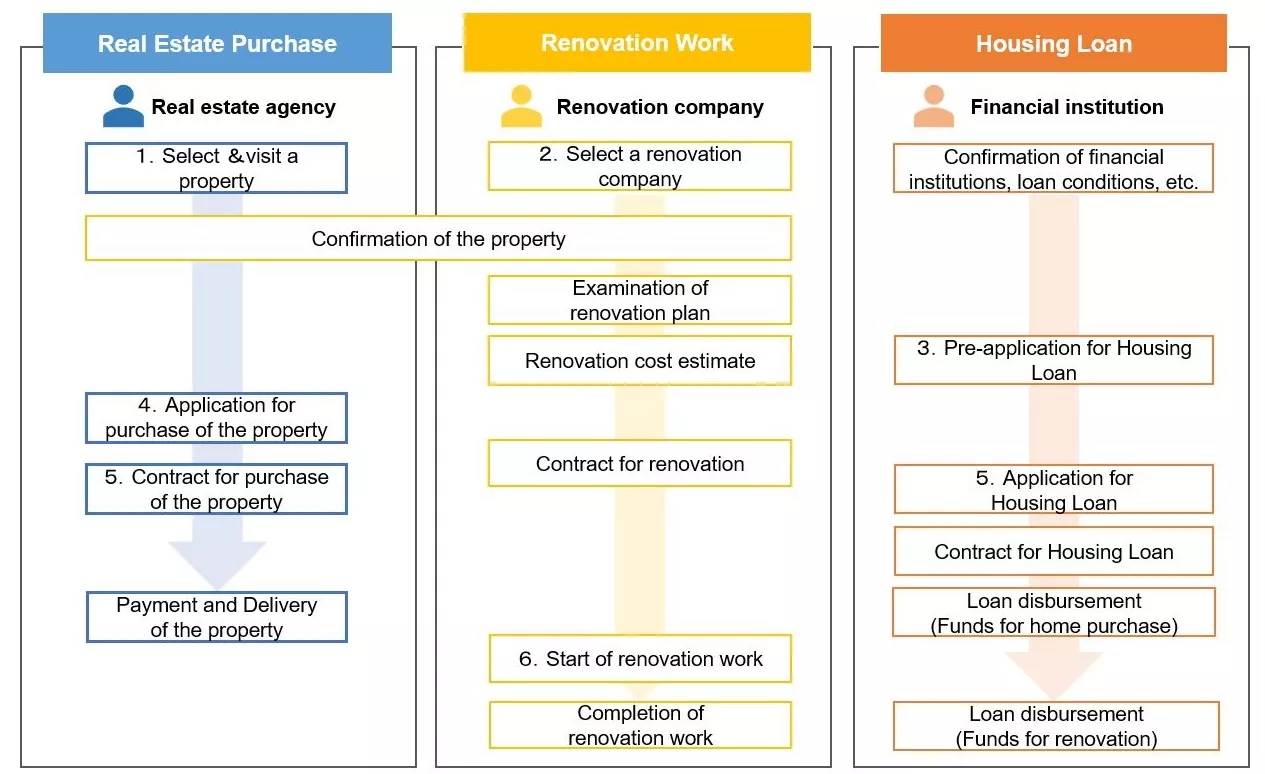

Loan for home purchase with renovation is a product that combines a housing loan and a renovation loan into one, so by the time you apply for the loan, you need to estimate the amount you wish to borrow for renovation costs as well. Specifically, you will need to submit an “Estimate of the renovation work amount” and “Renovation contract” to the financial institution when applying for the loan. The following is an explanation of the process of buying an existing house and renovating it. Since you have to purchase the house, consider renovation of it, and apply for a housing loan at the same time, it is important for you to consult with a real estate agency and to proceed in cooperation with the renovation company and financial institution.

Flow of purchasing existing house + taking out renovation loan

1. Select a property

Once you have visited a property and found the one you would like to consider buying, consult with the real estate agency to see if the desired renovation can be carried out.

2. Ask a renovation company for renovation

Some real estate agencies may be able to introduce you to a renovation company if you wish. If you have already decided on the renovation company you would like to request, you can arrange through the real estate agency for the person in charge of the renovation company to check the house. Then, you discuss the areas you want to renovate with the renovation company and ask them to provide you with a renovation plan and a cost estimate.

3. Apply for a housing loan to a financial institution

Check the terms and conditions of a housing loan at each financial institution and make a pre-application. If you apply for a “Loan for home purchase with renovation “, the loan will include renovation costs, so you will need to submit a cost estimate of renovation work and a renovation contract to the financial institution. It is a good idea to apply to several financial institutions in case you do not pass the screening process. The pre-screening period varies from 7 to 14 days depending on the financial institution.

4. Apply for purchase of a house

Once pre-approval for a housing loan has been obtained from the financial institution, through a real estate agency, apply for purchase of the house to the seller and negotiate and decide on the purchase price, delivery date, etc.

5. Contract for purchase of property - payment and start of renovation

Once you come to an agreement with the seller on the terms of purchase, a purchase contract is concluded. After the contract is concluded, a formal application is made for a housing loan, and after approval is obtained in the screening, the payment is made for the purchase contract. The period from contract to payment depends on the content of the agreement between the seller and buyer, but generally ranges from two weeks to three months.

Renovation work can start once the payment has been completed and the house has been delivered to the buyer. With the seller's consent, it is possible to check the house with the renovation company and discuss a more detailed renovation plan even before payment.

6. Start of renovation work – completion

After the house is delivered, the renovation work begins. Once the renovation work is completed, a prescribed “Construction Completion Report” is submitted to the financial institution. Then, the financial institution transfers the renovation loan amount to the renovation company.

It is important to note that, depending on the renovation contract, the time of payment of the contract price may be 50% at the start of renovation, 50% at completion of it, etc., which may require personal funds to be temporarily prepared at the start of renovation work.

How to proceed with real estate purchase, renovation work, and housing loan

Case of “Loan for home purchase with renovation”

Types of financing the purchase and renovation of preowned houses

1.To use a housing loan to purchase the house and your own fund for renovation

This type is suitable for simple renovations, for example, when renovation costs are low, for those who have some personal funds, or for those who can receive financial assistance from their parents. It is a good idea to use as little of your own funds as possible for the purchase of a house and to be able to use your own funds for renovation costs.

2.To use a housing loan for housing purchase and renovation loan for renovation

A housing loan and a renovation loan are taken out respectively. During the repayment period of the renovation loan, the burden of the repayments is heavier as it is doubly repaid with the housing loan. But it is suitable if the renovation costs are only a few hundred thousand to a few million JPY.

3.To use a housing loan available for both housing purchase and renovation costs.

This is the case of “Loan for home purchase with renovation”. This is recommended for older housing properties where the cost of renovation is high, the renovation idea is firmed up, and the renovation plan can be decided on quickly.

When purchasing a preowned house and renovating it, the first step is to select a housing property. Consult a real estate agency in advance about the image of your ideal house and your financial plan. As a speedy response is required for the purchase of a preowned house, it is important to work with a real estate agency to sort out the conditions required for the house to be purchased, while also considering the possibility of renovation, the pattern of using loans, and so on.

- Rental Apartments & Houses in Tokyo

- Listings of popular and luxurious rental apartments, condominiums, and houses designed with expats in mind.

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.