Land value trends in 100 selected districts of Japan’s major cities

Declined in 40% districts due to the influence of the new coronavirus pandemic

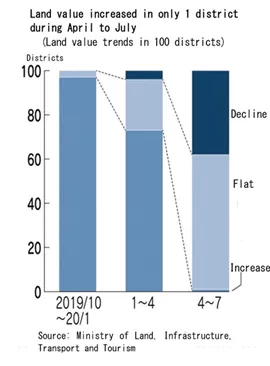

On April 21st the Ministry of Land, Infrastructure, Transport and Tourism released a report on the land value trends for the second quarter of 2020 (April 1 to July 1) in 100 selected districts of Japan’s major cities. The report shows that the number of districts where the estimated land value trend has declined, increased from 4 districts in the previous survey (Jan.1 to April 1) to 38 districts. The results of the report show that the stagnation of Japan’s economic activities—caused by the new coronavirus pandemic—has begun to push down land values in Japan. In contrast the number of the districts where the estimated land value trends have gone up has sharply declined from 73 districts in the previous survey to only 1 district. The number of districts where the land value trends are flat has surged from 23 districts to 61, showing the situation in which the continuous moderate upward trends of land prices in Japan over the past years are taking a downward turn.

The above report, which has highlighted the change in Japan’s land value trends this time, is called "Land Value LOOK Report" and is based on a survey conducted by Ministry of Land, Infrastructure, Transport and Tourism. This is a quarterly report based on the survey of the land price fluctuation spanning three months at a time in a total of 100 districts in major cities nationwide. This includes commercial areas in front of the local railroad stations and residential areas around those stations. It is a complementary indicator of Official Average Roadside Land Prices (calculated as of January 1st) and Standard Land Price (calculated as of July 1st), both of which are released only once a year, and can be used as a quick estimation and a summary indicator to clarify leading land value trends in Japan.

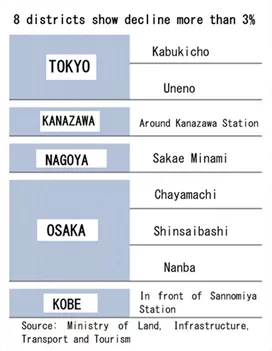

The decline in land value trends is noticeable in metropolitan areas with many commercial districts that have been influenced by the local consumers self-quarantine and business suspension request by the Japanese or the local government office. In the Osaka area, where many shops depend on foreign visitors, the number of districts with declining land value has reached about 70%—17 out of the total 25 districts—and in the Nagoya area all 9 districts have marked as declining.

In the Tokyo area, the number of districts with a flat fluctuation of land value has remained at about 90% of the total 43 districts. However, an entertainment district, a district with many hotels for foreign tourists, and a district where commercial facilities are concentrated, the land value trends are in quite a severe situation. In Kabukicho and Ueno district, the decline fluctuation has been evaluated as “3 - 6 % decline” from the previous survey results of “0 - 3% decline” , and in the district around the Ginza 4-chome intersection the fluctuation has turned from a flat level to a “0-3% decline”.

The report also shows that by comparison, according to the use of lands, declines are more noticeable in the commercial areas than in the residential areas. When compared according to the region, more declines can be seen in the districts of the three major metropolitan areas (Tokyo, Osaka, Nagoya) than in any of the regional districts.

According to the report by the Ministry of Foreign Affairs, the main factors affecting the land value trends are: 1) declining land value trends result from the concerns about the possible and on-going decline in profitability of commercial facilities, such as hotels and stores, which is caused by consumers self-quarantine and decreasing demands due to the influence of the new coronavirus pandemic, but 2) there has been no significant change in keeping the supply-demand balance of condominiums and offices (the disruption of the balance was the main cause of the decline in land prices during the Lehman shock). It is predicted that the actual demands for real estate in the Tokyo metropolitan area, especially for housing needs, are likely to remain strong. Further details regarding the land value trends, will be available once the results of Standard Land Price—which will be released in the late September—are announced by the Ministry of Land, Infrastructure, Transport and Tourism.

(Sources and references: 2020/08/21 Press Release Materials of Ministry of Land, Infrastructure, Transport and Tourism, 2020/08/22 NIKKEI Newspaper)

- Rental Apartments & Houses in Tokyo

- Listings of popular and luxurious rental apartments, condominiums, and houses designed with expats in mind.

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.