Agent commission for real estate transactions in Japan

In Japan, agent commissions are often paid in real property transactions, but many people may wonder why should they be paid? So, we will explain here what the agent commissions are and how the amounts are determined, etc., for the case of buying, selling, and leasing.

What is an agent commission?

This is a fee paid to the real estate company for its intermediary service when a sales contract or lease contract is concluded. To facilitate the process toward conclusion of a contract, the real estate company that acts as an agent posts the information of the real property requested by the seller or lessor, on its own website or various property information websites, creates leaflets, videos, and conducts various other advertising activities. In addition, the company perform various tasks essential to the conclusion of a contract, such as guiding clients to the properties, researching the property to be contracted, adjusting the conditions of a contract, preparing contract documents, and explaining important matters at the time of the conclusion of a contract.

An agent commission is what you pay for such activities. Since it is a contingency fee, you do not have to pay it if the contract is not concluded.

How is the commission amount determined?

The maximum amount of the agent commission is set by the Building Lots and Buildings Transaction Business Act and is calculated in the following manner.

Contract for Sale

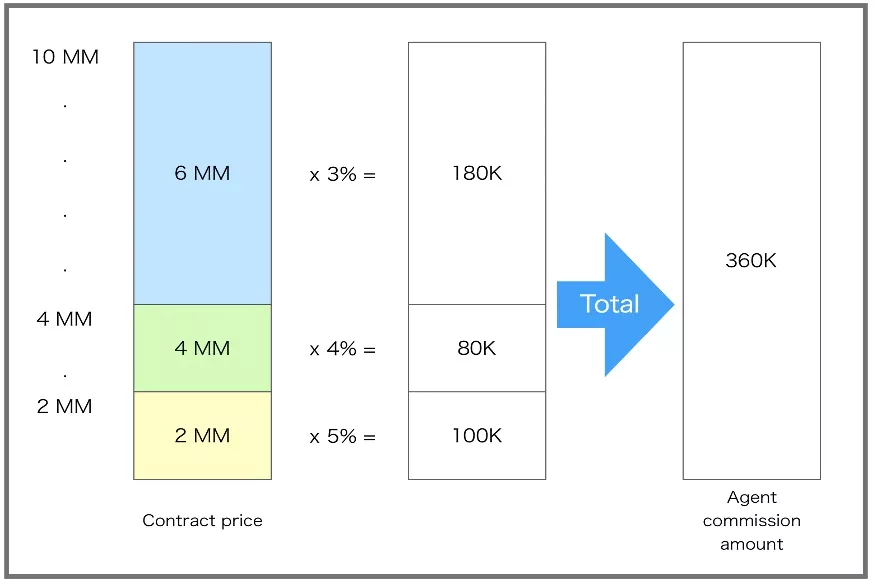

The upper limit is calculated depending on the contract price, such as “5% or less for the portion of the contract price of 2 million JPY or less”, “4% or less for the portion of the contract price over 2 million JPY and 4 million JPY or less”, and “3% or less for the portion of the contract price over 4 million JPY”.

Example) When the contract price is 10 million JPY.

Commission for the portion of 2 million JPY or less: 2 million JPY x 5% = 100,000JPY

Commission for the portion over 2 million JPY and 4 million JPY or less: 2 million JPY x 4% =80,000JPY

Commission for the portion over 4 million JPY: 6 million JPY x 3% = 180,000JPY

Total: 360,000 JPY

As shown above, the calculation must first be divided into the price ranges and then added each results together at the end, so it is not a simple calculation of 10 million JPY x 3% = 300,000 JPY. This troublesome calculation formula is simplified by what is called the following quick calculation formula. The same amount of agent commission can be calculated by both the above regular calculation method and the below quick calculation formula.

In the case of quick calculation formulas

Commission for the portion of 2 million JPY or less: 5% or less

Commission for the portion over 2 million JPY and 4 million JPY or less: 4% or less + 20,000JPY

Commission for the portion over 4 million JPY: 3% or less + 60,000JPY

With this calculation method, there is no need to calculate the contract price by dividing into the price ranges, and if the contract price is applied directly to the above formula, the same agent commission amount can be calculated immediately.

Example)

When the contract price is 10millionJPY

10million JPY x 3% = 300,000 JPY

300,000 JPY + 60,000 JPY = 360,000 JPY

When the contract price is 3million JPY

3million JPY x 4% = 120,000JPY

120,000 JPY + 20,000JPY = 140,000JPY

*The contract price is the price that does not include the consumption tax. Consumption tax is not imposed on land transactions and on single-family houses and condominiums (mainly pre-owned properties) sold by individuals, but is imposed on newly built condominiums and other cases where the seller is a corporation. When calculating the agent commission amount based on the sales drawing, it is necessary to confirm in advance whether the displayed price includes consumption tax.

Lease Contract

It is stipulated to be the amount of one month’s rent or less.

*Rent set forth above is the amount that does not include consumption tax. Rent for residential properties is tax-exempt, but since rent for properties used as offices is taxable, the rent prices including consumption tax are often described on the recruitment drawings, so the agent commission amount should be calculated excluding the consumption tax.

Is a consumption tax imposed on agent commissions?

A consumption tax is imposed on agent commissions for both sales and rental contracts. Since it is paid as consideration for services performed by a real estate agent, it is subject to consumption tax.

Is it possible to reduce or eliminate agent commissions?

Some real estate companies advertise their services with "no agent fee required" or "half off agent fee," but as explained at the beginning of this article, agent commissions are paid as consideration for the various services provided by real estate agents. Due to the nature of contingency fees, even if the agents spend a lot of money and show their clients numerous properties over a long period of time, they cannot charge agent commissions unless the contracts are concluded. Therefore, the agent commission paid at the time of the conclusion of contracts becomes the main source of income for the real estate company. In many cases, the real estate companies which provide their services with reduced agent fee may charge their customer fees other than the agent fee, such as a "property disinfection fee" or "document preparation fee," in order to secure their income, and in some cases, the customer may have to pay the same amount or more than the agent fee as a result.

A reduction of the agent fees, etc. may be applied only to the properties that the seller or lessor really wants to close their contracts quickly. In such cases, you may have to choose a property from a limited number of options, and you may not be able to find a good property.

Summary

The agent commission is a necessary fee to find the best property for you and assist your responsibly until the conclusion of the contract.

It may be difficult for you to decide whether to spend less and compromise on the services you have, or to spend more but have adequate services and contract a satisfactory property. However, we believe that purchasing or renting real estate is one of the major events in your life, so we would like you to choose a reliable real estate company and find a wonderful property so that you will not have any regrets.

- Rental Apartments & Houses in Tokyo

- Listings of popular and luxurious rental apartments, condominiums, and houses designed with expats in mind.

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.