Japan Consumption Tax Hike 2019: How it Will Affect You

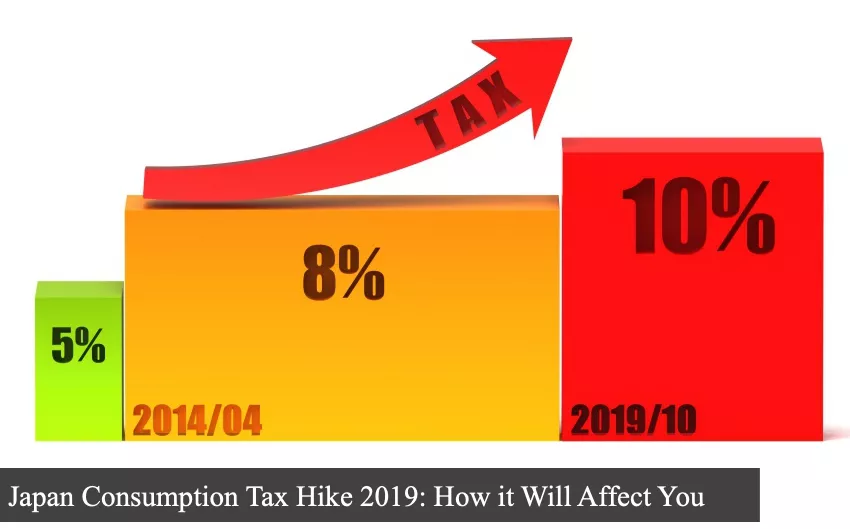

Fall is the season of change — leaves turn red, frost descends, and winter coats start to emerge from storage. This year, however, will bring more than just cozy sweatshirts, as Japan’s government is set to increase the consumption tax to 10% (an increase of 2%) beginning October 1, 2019. With a veritable maze of regulations and exemptions, it can be confusing to understand which items will be subject to the tax hike, and what will remain at the current 8% consumption tax.

Why is Japan Raising the Consumption Tax?

This new 10% tax rate is one of several measures by Prime Minister Shinzo Abe’s government to help ease the burden of an aging population. There are significantly less citizens working and contributing to social welfare systems than previous decades, and it shows.

By 2025, all baby boomers will be over the age of 75, and the system needs more capital to be able to support this new normal. According to official projections, the extra 2% tax will create almost 14 trillion yen (1.3 billion USD) in new revenue, covering basic expenses, childcare, and early education, and decreasing an ever-present national debt.

This isn’t the first tax hike Abe has pushed through an often-reluctant Diet.

In 2014, the consumption tax was raised to 8% after spending 15 years at 5% (4% for national tax and a 1% local tax). This bill passed through the Diet originally intending for the newest 2% tax hike to go into effect in 2015 but proved to be too difficult with the vestiges of Japan’s precarious post-Lehman failure economy and was postponed for several years.

Potential Downsides with Raising the Consumption Tax

Not all economists agree, however. With inflation not currently a problem, many domestic and international economists alike feel that the consumption tax is unnecessary at best, and at worst may harm the deflating economy significantly. With the economy in a downturn, austerity measures may further push consumers away from spending and continue the trend toward less customer activity as a whole.

Abe has announced plans to help combat this, pointing out that elderly people now will also continue to contribute to their own funds. The official blueprint also outlines plans to raise the minimum wage from the current 874 yen (8.08 USD) to 1,000 yen (9.24 USD) per hour.

While there is no doubt that the 2020 end-of-year debt estimate of 847 trillion yen is astronomical, this tax hike is an unpopular fix — and not only because of the money. It can be difficult to understand exactly which products will be affected under this new tax increase, and there are some interesting exclusions and inclusions.

What Items are Subject to Japan’s Consumption Tax Hike?

Starting October 1st, the original 8% rate will be officially called the “reduced rate,” while the new 10% rate will be called the “regular rate.” Non-consumable items will be taxed at the new regular rate, while there are some exceptions for consumables.

Groceries

In general, food and drinks will continue to be available at the reduced 8% rate, so the majority of daily groceries will not be affected. Liquor, on the other hand, will be sold at the new 10% consumption tax (this includes cooking alcohol like sake and mirin).

Restaurants, Cafes, and Convenience Stores

There is quite a bit of confusion regarding the phrase “dining out,” which now is included in the 2% hike.

Any place that sells prepared food and has seating may require you to announce whether you are dining on the premises or ordering takeout. If you eat the food inside the restaurant, café, or convenience store, you will be required to pay the 10% rate; if you wait to eat the food until you have exited the business, you will pay only the 8% rate.

Commuter Passes

The new regular rate will also affect the commuter pass system, a cornerstone of Japanese corporate life. Passes will be at the 8% tax rate until the end of September, when they’ll change to the new regular 10% rate, causing a rush of businesses hoping to get longer-term passes before the deadline to create tax savings in the long run.

Rebate Incentives

There is good news, however. Also beginning in October, certain stores will start participating in a cashless payment rebate system, where consumers will earn around 5% of their purchase in the form of points that they can then exchange for cash or gift cards. This 5% back would effectively take a 10% rate and essentially cut it in half.

Abe included these incentives as part of his official cabinet blueprint in the hopes that it would quiet critics, who demanded they offset the tax burden on mostly young, low-income Japanese citizens not flush with cash. But this system has its rules, too.

The business itself needs to have a buy in, and will be available for a number of goods and services, not only food and drink. Participating businesses can be identified by the red-and-yellow cashless check logo, which should be placed somewhere easy to find for the average customer.

This reward program will run from October of 2019 to June of 2020, when economists can then use the data collected over the months of the program to better inform spending and consumer habit tracking.

Property Tax Advice from Plaza Homes

Japan’s taxes and regulations can be confusing. If you’re in the market for housing in Tokyo, our bilingual realtors can comprehensively guide you through the necessary steps for acquiring property in Japan. Please visit any of the guides below for more information to get you started.

Learn More:

- Property Buying Costs and Taxes in Japan

- Explaining Fixed Asset Tax and City Planning Tax for Non-resident

- Real Estate Rental Income Tax in Japan

- Property Selling Costs and Taxes

- Withholding tax of the real estate sales by Non-resident

- Rental Apartments & Houses in Tokyo

- Listings of popular and luxurious rental apartments, condominiums, and houses designed with expats in mind.

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.