Deal Analysis Tokyo – Edogawa Hotel Room Unit

The following deal analysis was written by Ziv Nakajima-Magen – Partner & Executive Manager, Asia-Pacific Nippon Tradings International (NTI)

“Institutionalised” Sub-Leasing Arrangements

Sub-leasing is a popular rental strategy, in which a tenant – usually a company specializing in short term rentals – signs a master lease in front of a property owner and landlord, for a fixed monthly amount, and then make it their business to sub-lease the property to others – normally short term tenants, or tenants who cannot otherwise lease a property for various reasons such as being on short-term visas, having no guarantors or other securities, etc.

The landlord enjoys a stable and fixed monthly income, regardless of whether there’s an actual tenant in the property or not, and does not need to concern themselves with vacancies, finding new tenants, small maintenance and repair requests and so forth – and the sub-leasing tenant enjoys the benefits of rental income, without having to actually purchase a property themselves.

And, while there are plenty of companies specializing in this practice, who regularly offer their services to landlords in search of hassle-free, hands-off property management, it is more rare to come across an entire building, or several floors of a building, being leased and managed in this way.

However, this more “institutionalized” form of sub-leasing does exist, particularly in Japan’s larger metropolitan centres – in these cases, the main advantages for the landlord are two-fold –

1. The fact that an entire building or large parts of it are being advertised, managed and otherwise handled in this way, makes for longer term potential for the arrangement to continue as far as the eye can see. While sub-lease companies can essentially terminate their master lease at any time, this is far less likely to happen in the case of a larger scale operation such as a “hotel building” – which, in all likelihood, will maintain the sub-leasing strategy for its entire life-span, provided it remains profitable for all involved.

2. In the case of the entire building or floor being managed via sub-lease agreement, there are normally far more items included in the “free maintenance” list the sub-leasing company would be responsible for. Furthermore, since the property is, for all practical purposes, a hotel of sorts, there will often be improvements and upgrades made collectively to all units under management – which, even if they do cost the unit owner something, are almost always done in bulk purchases for a large number of units – which means that costs are reduced significantly, and are, in fact, often undertaken completely by the sub-leasing company, which is interested in maintaining the units at a high standard, to allow them to charge their guests a higher premium for their stays.

Tokyo Location, Small City Pricing

There are, of course, also dis-advantages to this sort of arrangement – the main one being, that properties purchased under these arrangements, cannot be re-purposed and re-utilized for other uses by the landlord – as the building’s management company and owners’ co-op have enshrined the sub-leasing arrangement in the property’s by-laws, which must be adhered to.

What this means in practice is, that even if the sub-leasing company decides to re-negotiate the master lease terms upon contract renewal – typically every 1-3 years – the owner has very little choice in the matter. All they could do, if they are unhappy with the price the sub-leasing company is willing to offer, is try and sell the property – and considering the fact that the rent payable may have dropped upon contract renewal, as a result of economics related to demand, pricing, higher management or maintenance requirements, or any number of different reasons – market price may also drop accordingly. This is unlikely to happen if the property is in an attractive location which has been gaining in popularity and price, but is always a remote possibility that needs to be taken into account upon purchase.

For this reason, not all investors will be willing to take on such a proposition – and with the lower buyer base, prices can be negotiated as well, which makes the market for properties being managed in this manner a buyers’ market.

It is for this reason that one of our clients, a Canadian investor who is currently living and working in Tokyo, has managed to purchase the property described below at the highly discounted price of 4.4 mil JPY - just over 40,000 USD at the current exchange rate.

The Numbers

The rest of the numbers involved in this deal, aside from the substantially discounted price, are as follows –

- Building fees are 12,500 JPY per month (including building management and reserve funds contributions)

- Master lease rent payable to the landlord is 37,800 JPY

- NO property management (tenant management) monthly fee

What this all translates to, including all purchase and running costs, is a bottom-line annual yield of approximately 5.7% net pre-tax – far higher than most Tokyo properties will generate (normally 3-4.5% at best).

Due Diligence

As there isn’t really any tenant due diligence to be performed for this type of property, the main items under consideration were building management fundamentals, such as renovation history, reserve funds pool status, and so forth.

These were satisfactory, with most larger ticket items performed over the last 12 years – including the building’s exterior, elevator systems, hot water supply systems and water pumps, pipes and exposed iron fittings, which have been re-painted and anti-rusted on a regular basis.

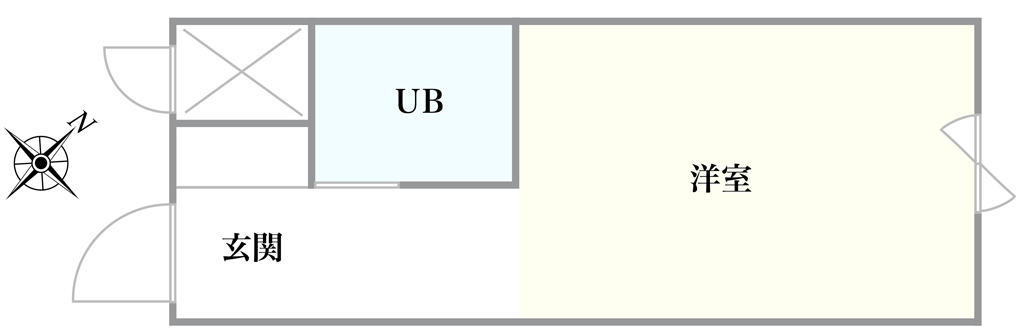

Lastly, and as mentioned above, the unit interiors have been regularly maintained and renovated, at no cost to unit owners – which is an added bonus, that more than covers for the relatively depleted reserve funds pool – approximately 14 mil JPY at the time of purchase, which, for a building constructed in 1988, and holding 116 studio units, is a relatively low amount.

Deal Analysis

Considering our investor’s particular circumstances – specifically, affordable, low-capital outlay properties in Tokyo, which is a contradiction in terms most days of the week – this was a really no-brainer from our perspective – it was, and remains to this day, an extremely difficult task to find affordable properties generating reasonable yields in Tokyo city – let alone at this low price. While, conceivably, there may be some older suburban properties available for sale around the outskirts of the greater Tokyo metropolitan areas, it is extremely unlikely to find any that are as hands-off, turn-key and hassle-free as these sub-leased hotel type properties.

Having considered the advantages and dis-advantages detailed above, the client has decided to green-light the deal. This was back in April 2018, and as anticipated, there has not yet been a single issue related to this property, which has been functioning as smoothly as expected to this day.