Low Interest rates of Housing Loans in Japan – Points for choosing a Housing Loan

Because loan interest rates in Japan have remained low in recent years, most of the people who buy their own homes use a housing loan to do so. In this article, we would like to explain interest rates of housing loans, types of interest rate and their characteristics, and repayment methods as the points for choosing a housing loan. For an overview of housing loans and financial institutions that offer them to foreigners, please see Guide to Home Mortgage Loans in Japan.

Housing loan interest rates in Japan have remained historically low

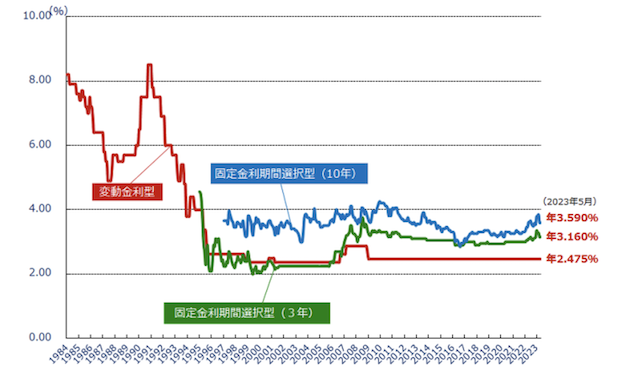

The most worrisome point for those who consider using a housing loan is the current mortgage rates and interest rate forecast. First, let’s look at how mortgage rates in Japan have fluctuated so far and what has become of the latest interest rates. This graph shows the fluctuation of mortgage rates of private financial institutions in Japan since 1984.The red line shows the variable mortgage rate, the blue line shows the 10-year fixed mortgage rate, and the green line shows the 3-year fixed mortgage rate. The variable mortgage rate exceeded 8% around 1990 but fell to nearly 2% in 1996 due to a sharp decline in stock and land prices (economic bubble burst) from 1991 to 1993. Since then, interest rates have remained low, and partially due to the negative interest rate policy of Bank of Japan from 2016, mortgage rates have remained historically low until May 2023.

Variable rate mortgages (2.475% per annum)

10-year fixed rate mortgages (3.590% per annum)

3-year fixed rate mortgages (3.160% per annum)

Reference: Japan Housing Finance Agency, “Historical mortgage rate fluctuations at Private Financial Institutions (variable mortgage rates, etc.)” Interest rates shown in the graph are the rates (medium values) that are aggregated from the websites, etc. of major city banks.

Although it is difficult to predict how mortgage rates will fluctuate in the future, it is important to pay close attention to the latest economic situation because mortgage rates fluctuate due to the effect of economy, prices, exchange rates, and other factors. Currently, mortgage rates are at historically low level, so they are unlikely to fall further and may rise gradually depending on the economic trends.

How mortgage rates work?

What are over-the-counter interest rates (base interest rates), preferential interest rates, and applicable interest rates?

According to the graph above, as of May 2023, variable mortgage rate is 2.475%, 10-year fixed rate is 3.590%, and 3-year fixed rate is 3.160%, which are different from the mortgage rates applied at the time of taking out a housing loan.

In fact, each financial institution examines the loan application, and the “applicable interest rate”, which is obtained by subtracting the “preferential interest rate (preferential rate or reduction rate)” from the “over-the-counter interest rate” described below, is the final interest rate used for the loan contract. Competition of housing loans among financial institutions is very fierce, and mortgage rates are reviewed monthly. When choosing a housing loan, please check the preferential interest rates and conditions of each financial institution and compare the applicable interest rates among those financial institutions.

Over-the-counter interest rates (base interest rates)

-Variable interest rate: It is determined by Bank of Japan’s short-term prime rate as an index. It has not changed for more than 25 years.

-Fixed interest rate: It is determined by the yield on new 10-year government bonds (long-term government bonds) as an index.

It is determined by each financial institution for own rate, but since it is based on public index, the interest rate is almost same among those institutions.

Preferential interest rate (preferential rate or reduction rate)

It varies depending on the sales policy, product, sales campaign in cooperation with a credit card company, etc. of each financial institution. In order to qualify for preferential interest rates, you must satisfy the conditions specified by financial institutions. It is determined by the screening at the time of taking out a housing loan (about annual income, loan amount, collateral value of the real estate to be purchased, own funds, repayment amount, etc.)

Applicable interest rate

The interest rate obtained by subtracting preferential interest rate (reduction rate) from the over-the-counter interest rate. The interest rate of the loan contract.

[Example case]

SMBC Trust Bank PRESTIA Mortgage Rate Plan (as of May 2023)

| Base Rate | Preferential Rate | Applicable Rate | |

| Variable Rate | 2.63% p.a. | -2.04 ~ -2.24% p.a. | 0.39~0.59% p.a. |

| 10-year Fixed Rate | 3.14% p.a. | -1.98% p.a. | 1.16% p.a. |

For more information, please see the website of SMBC Trust Bank PRESTIA

When is the applicable interest rate determined?

Regarding the applicable interest rate, it is also important for you to know at what point the interest rate is applied. Normally, it is either “the interest rate at the time of loan application” or “the interest rate at the time of loan execution”, but for housing loans of many private financial institutions, “the interest rate at the time of loan execution” is commonly applied.

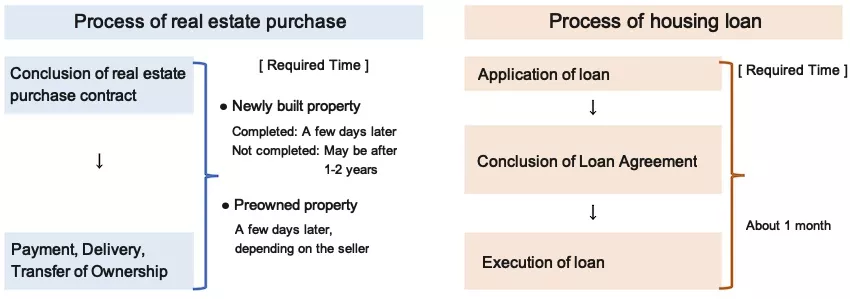

The purchase of real estate and the application for a housing loan are proceeded in the flow shown in the below figure. After concluding the real estate purchase contract, you will apply for a housing loan, go through the loan screening, sign the loan contract, and then the loan will be executed. Since the loan is executed on the same day as the payment date under the real estate purchase contract and the delivery date of the property, the timing of loan execution depends on the delivery time of the property.

Process of real estate purchase and housing loan

If it is a newly built property or a preowned property that can be moved in immediately, the loan may be executed, and the property may be delivered about one month after the loan application. In the case of a preowned property, the delivery time of the property depends on the requests of the seller and the buyer or various reasons, so it may be about 1 month later or in some cases 6 months later or more. When purchasing a new condominium apartment that has not yet been completed, the delivery time and loan execution time may be more than 1 year away.

If the loan execution takes some time after applying for a housing loan, it is important for you to check with the financial institution in advance at what point the loan interest rate will be applied and to note that the interest rate may increase until the loan is executed.

Types of Interest Rate and their Characteristics

There are 3 types of mortgage rates: “Fixed rate mortgages for the entire loan period”, “Variable rate mortgages”, and “Fixed rate mortgages for selectable period.” Depending on the mortgage rate types, the interest rate to be applied and the total repayment amount may differ, so it is important for you to understand their characteristics before your choice.

1. Fixed rate mortgages for the entire loan period

During the repayment period, the interest rate is fixed all the time and the repayment amount does not change.

[Characteristics]

The interest rate is not affected by future fluctuations, and the repayment amount is fixed. So, it gives us a sense of security while the interest rate is higher than other types of interest rate.

2. Variable rate mortgages

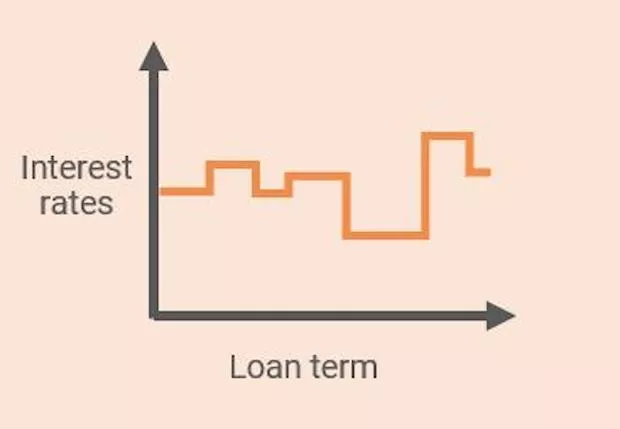

During the repayment period, the interest rate is reviewed every 6 months, and the repayment amount is reviewed once every 5 years.

[Characteristics]

- Since the interest rate is reviewed twice a year, it is subject to future fluctuations of interest rate.

- The interest rate is set at the lowest among the other types of interest rate.

- It is possible for you to change to Fixed rate mortgages for selectable period

Repayment plan for Variable rate mortgages

There are 2 types of repayment plan: “Principal and interest equal repayment” in which the monthly repayment amount is fixed, and “Equal principal repayment” in which the monthly repayment of principal portion is fixed.

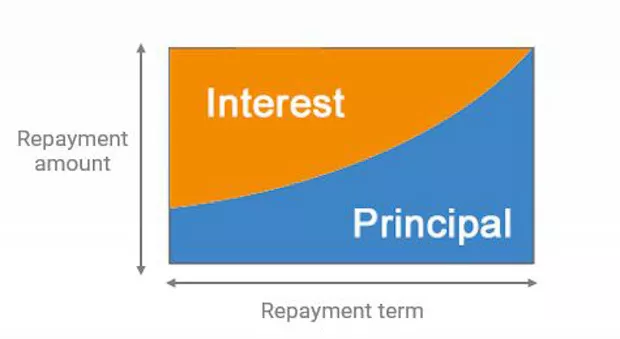

(1) Principal and interest equal repayment

It is a repayment method in which the monthly repayment amount (sum of principal and interest) is a certain fixed amount.

[Characteristics]

- Since the monthly repayment amount is the same, there is an advantage that it is easy to make a repayment schedule.

- The total amount of repayment will be larger than Equal principal repayment.

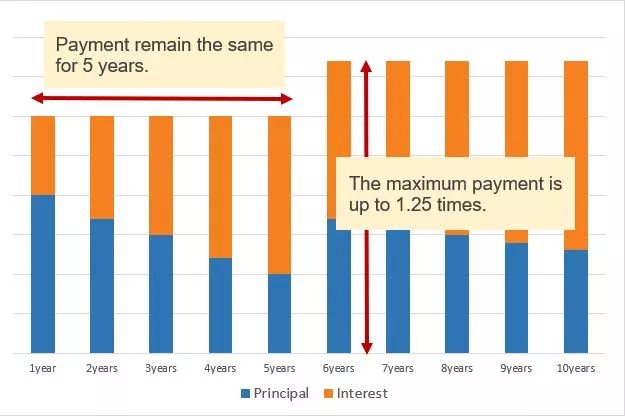

5-year rule and 125% rule

Many financial institutions generally review the repayment amount every 5 years but have established a rule that the repayment amount after the revision will be increased no more than 125% of the previous amount. It can be said that it is safe because a significant rise in interest rates will not affect households significantly, but if interest rates continue to rise sharply, most of the monthly repayment amount will be allocated to the interest portion of repayment, and the outstanding loan balance may not decrease. In addition, on the final repayment date, both the interest and the remaining principal must be repaid in a lump sum.

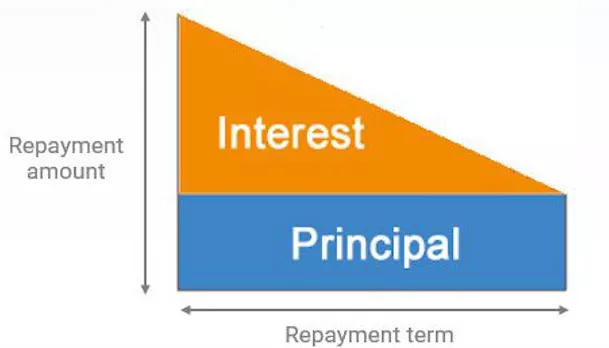

(2) Equal principal repayment

Since every repayment amount consists of a certain fixed amount of principal portion and variable interest portion, the repayment amount for each time gradually decreases according to the loan balance.

[Characteristics]

- The total repayment amount is smaller than Principal and interest equal repayment.

- The initial repayment amount will be larger than the later period.

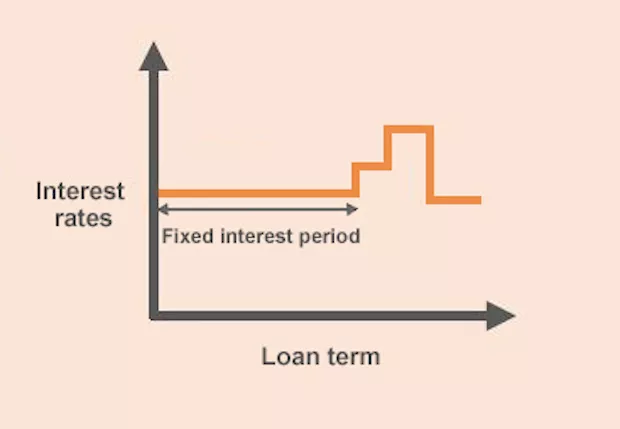

3. Fixed rate mortgages for selectable period

The interest rate is fixed for a certain period from the loan execution, such as 2 years, 3 years, 5 years, 10 years, and 20 years.

[Characteristics]

- The shorter the fixed interest period, the lower the initial interest rate.

- After the end of the fixed interest rate period, you can choose the variable interest period or another fixed interest period again, and the repayment amount for each subsequent repayment will be recalculated by the interest rate at the time.

- If interest rate rises significantly, there is no upper limit to the increase in the repayment amount, so the total amount of repayment may increase significantly.

Type of Interest Rate chosen by many Housing Loan users

We have explained the types of interest rate and their characteristics so far, but many people may wonder which one to choose, fixed interest rate or variable interest rate.

According to the Japan Housing Finance Agency’s “Fact-finding Survey of Housing Loan Users (conducted in October 2022)”, 69.9% of the people used “Variable rate mortgages”, followed by “Fixed rate mortgages for selectable period” at 20.1%, and “Fixed rate mortgages for the entire loan period” at 10.0%. When asked about the forecast of mortgage rates over the next 1 year, 41.7% of the people said the interest rates would be higher than the current ones, while 46.3% said the rates would hardly change.

Variable rate mortgages are popular because of their low interest rates, which are likely to fall below 0.5%, but they come with the risk of rising interest rates in the future and increase of repayment amounts. So please be careful to choose your best one based on your life plan, after understanding in advance the characteristics of each type of interest rate, the rules for applying preferential interest rates, as well as the risk of rising interest rates.

- Rental Apartments & Houses in Tokyo

- Listings of popular and luxurious rental apartments, condominiums, and houses designed with expats in mind.

- Apartments & Houses for Sale in Tokyo

- Listings of apartments, condominiums, and houses available for purchase in Tokyo.